As a natural evolution of the technology for money, we are seeing the emergence of new breed of currencies backed by cryptography taking the place of fundamental units of economics. Bitcoin has been the pioneer of cryptocurrencies set to replace gold to be the new ‘Gold Standard’ of currency system.

Bitcoin has its own advantages differentiating it from all the present payment networks and monetary instruments. Talking about one such property, Bitcoin unlike gold is infinitely divisible with up to eight decimal places currently in use.

While breaking down the units to such a miniscule level may sound idiotic, unmanageable and hard to comprehend at a first glance, it is an important trait that enables the future of a extremely deflationary economics.

Matter starts to exhibit new behaviour at Nanoscale. Similarly, radically different businesses models spring up when you open up sub-micro payments with the flexibility to innovate without permission.

What difference will the divisibility of bitcoin bring? Let us explore:

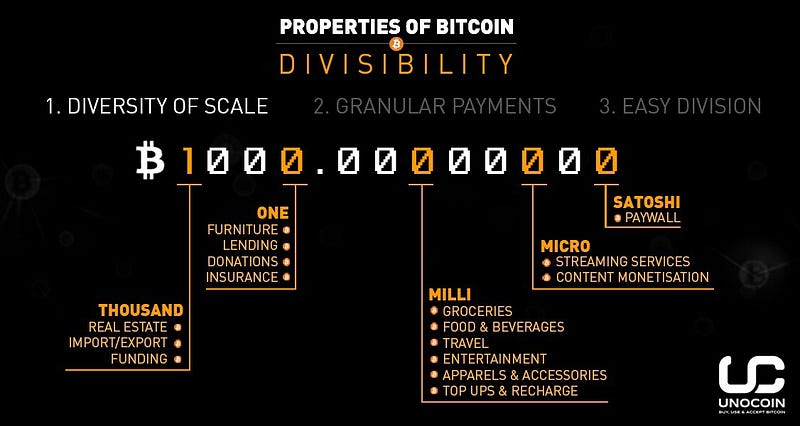

Diversity of scale

Bitcoin network allows a wide spectrum of transaction sizes ranging from sub-micro payment streams (in satoshis) to super-macro monetary settlements (in millions of bitcoins). While there exists infinite variety of transactional use cases, the image below helps to familiarise with some of the examples to understand the scale of payments on bitcoin network.

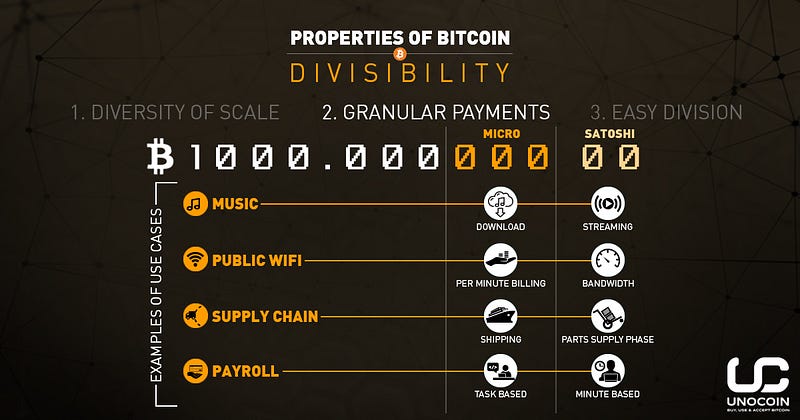

Granular payments

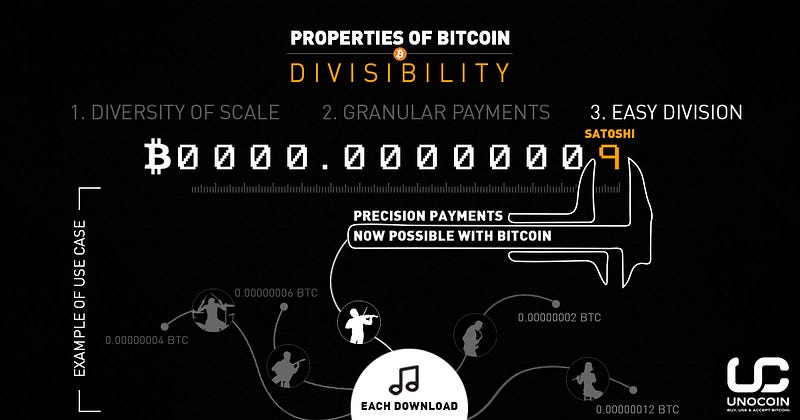

With such an extended flexibility, it opens up the possibility of indulging in granular payments which could happen at a very high frequency with motivating new variety of transactions such as ‘performance-oriented-payments’, ‘pay-for-what-you-use’, ‘supply-chain-reimbursements’, ‘creative-royalties’ etc amongst others.

Easy Division (Precision)

Infinite divisibility enables us to make payments with infinite precision. Each individual participant of a production channel can be directly included in the payment transaction holding precise amounts unlike bulk settlements delaying payments and abused distributed margins.