For every trade on Unocoin Exchange, earn 0.3% of the trade value in bitcoin.

Note: Applicable only for makers (who brings liquidity to the order book). Makers will be awarded 0.3% in BTC to their wallet for each executed trade.

Ever since bitcoins (and other cryptoassets) gained popularity, trades and transactions have been on a one-way trajectory. Trading cryptoassets is not a new concept of course, but there’s still plenty of room for new innovations and ideas in the industry!

Unocoin, India’s own cryptoasset exchange, too has promoted trading and transactions using cryptoasset. Recently, as we discussed earlier, Unocoin launched a multi cryptoasset exchange (with an open order book), which supports around 6 coins — including Bitcoin, Bitcoin Cash, Bitcoin Gold, Ripple, Ethereum, and Litecoin as well. This whole setup operates on a “Maker-Taker” model, commonly followed by financial institutions across the globe.

While we’ve touched on the concept of “Maker-Taker” earlier, let’s recap it for you.

Makers vs Takers

Say, we have two individuals, Alice and Bob. They can place two kinds of orders:

- Limit orders, in which one can specify their price to execute the trade at. The transaction will only go through when the condition put on the price is fulfilled.

- On the other hand, one can also place a market order, with the current best price, the trade is immediately completed upon the availability of the volume. However, there is no guarantee that the price will remain the same in the time it takes to complete the transaction. Your order will simply be matched to whatever open orders are there on the exchange.

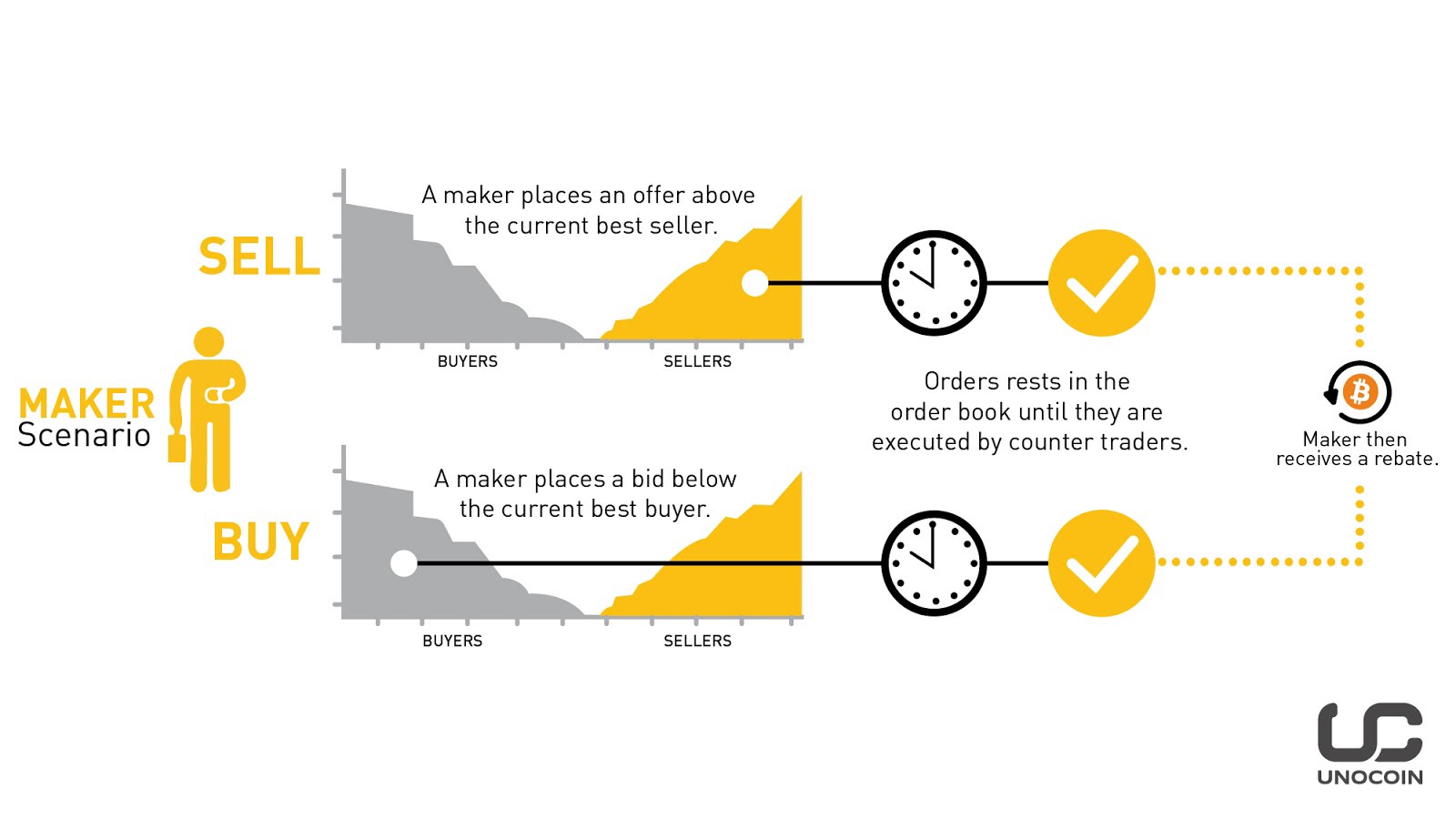

If Alice places a limit order, she is introducing more money (or liquidity) to the market, as the order is put on the queue. She is thus called a maker.

Now we have Bob, who places a market order which will immediately be executed if there’s an open order on the exchange — like Alice’s for example. Since this kind of order takes the liquidity off the market, he will be the taker.

This model provides the user with many benefits — the user is allowed to change the queued orders, or even cancel it. They can easily go with the market trends and fully utilize trading benefits.

Unocoin’s New Fee Offer!

Unocoin originally offered near rock-bottom fees of 0.4% to makers and 0.6% to takers on the launch of its exchange. But it isn’t done yet!

In an industry (and possibly global) first, Unocoin is turning the tables in favour of the makers. Makers on Unocoin’s exchange will now earn 0.3% as the bonus on their transactions. And that’s not all — this fees will be paid… in bitcoin. So not only do makers stand to benefit from their trades, they’re being rewarded in potentially larger sums if bitcoin continues to rally the way it has!

The taker fee continues to remain low — at just 0.6% of the order value. There is absolutely no fee in storing the currency in your wallet.

In the context of Alice & Bob — here’s how this would work out:

- Let’s say Alice places a limit buy order for 0.1 BTC @ Rs 6,00,000. The value of this transaction would, therefore, be Rs 60,000.

- Bob comes into the picture. Let’s say he’s doubled the value of his holdings on bitcoins and has placed a market sell order to offload 0.1 BTC from his holdings.

- This order gets matched with Alice’s, and gets executed. Alice is now the maker, and Bob the taker.

- According to Unocoin’s new pricing model — Alice would be receiving 0.3% of the transaction value — that is, Rs 180 for this transaction. What’s more — this payout would be in the form of bitcoin itself, and not INR — which means she would make 0.0003 BTC (calculated using the last traded price at the moment of the transaction) for trading cryptoassets herself.

- Bob on the other hand — would be subject to a nominal 0.6% — which translates into a fee of 0.6% — or Rs 360 — on the transaction.

So, go ahead! Open your Unocoin account, and get into the arena of trading. May the odds be ever in your favour!