There are myriads of cryptoassets and altcoins being spoken about across the world. People are weighing in the pros and cons and purchasing some cryptoasset every second. With this growing frenzy of cryptoassets, the statistics that show the unique characteristics of this set of cryptoasset investors that are common across the globe, are intriguing!.

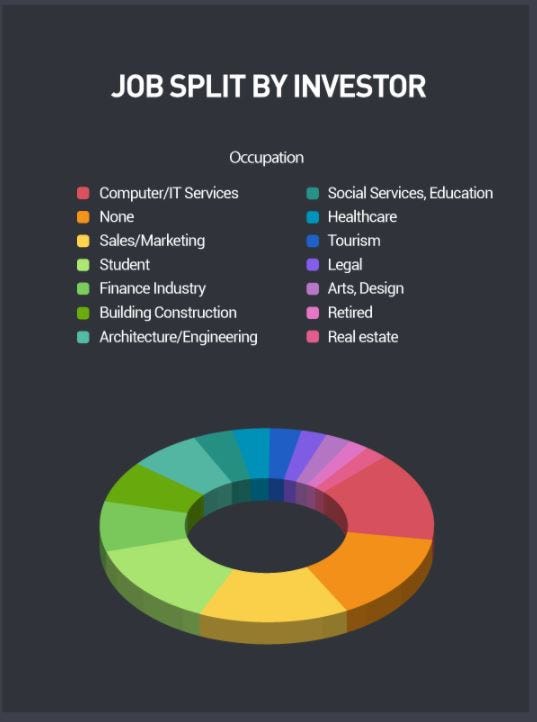

The investor demography is dominated by young males

An eToro report dated May 10, 2018 states that only 8.5% of all cryptoasset investors are women.The majority of the cryptoasset traders (91.5%) are men. Furthermore, most of the people investing in cryptoassets either work in the Computer/ IT services sector, sales/ marketing industry or are students or unemployed individuals. If one looks at the range of ages of the cryptoasset investors, it is driven mostly by young people aged between 18–35 years. This clearly states that the majority of the investor demography is driven by young males.

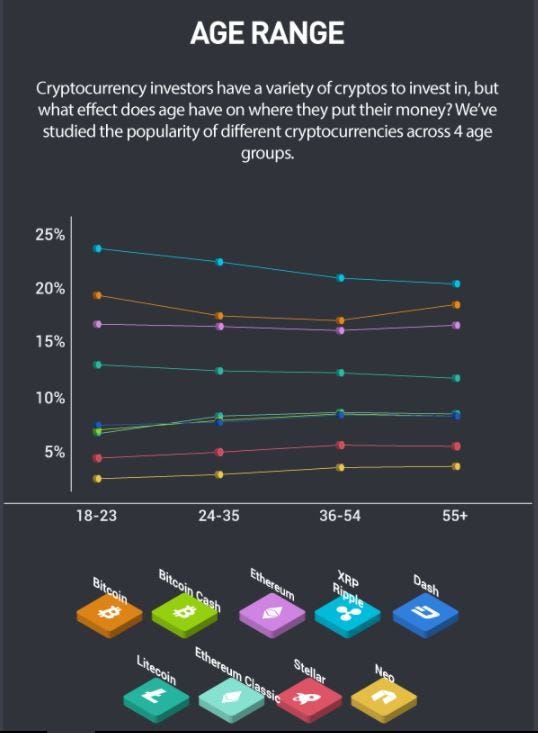

Popularity of the cryptoassets varies across the age groups of investors

The young investors are creating portfolios padded with the most popular crypto-coins available in the market viz. Bitcoin, Ripple, and Ethereum. Despite their higher risk tolerance, they seem to have an affinity towards the safer crypto-assets. Having said that, it is also evident that older investors (aged 55+) have portfolios comprising of more altcoins like Bitcoin Cash, NEO, and Stellar than their youthful counterparts.

Majority of the total cryptoasset trading population consider themselves to be novices

The cryptoasset industry is at a nascent stage and is still evolving at a rapid pace. Most of the investors of this industry come from a diverse background and over 75% of them place themselves as novices in the field. They consider their expertise and knowledge of the sector to be at the beginner level.

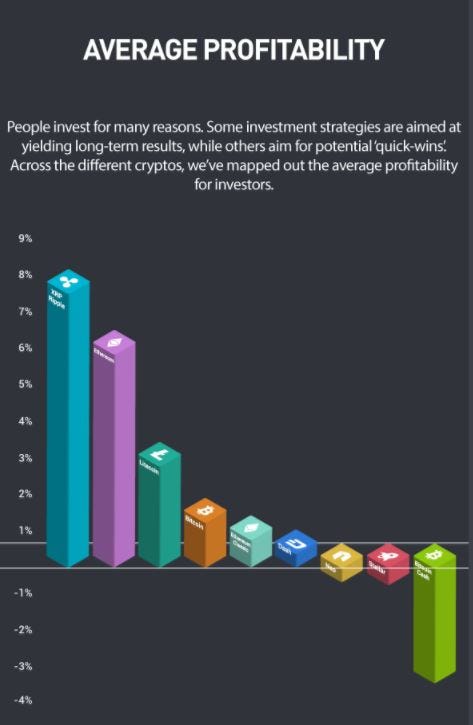

There is a stark trend in the average profitability of investors

With the majority of investors being novices in the industry, one would expect high rates of losses and negative returns in the field. However, the data from eToro reveals that most traders have gained positive returns on their cryptoasset investments. While Neo, Stellar and Bitcoin Cash show a negative average profitability, Ripple shows the highest positive profitability followed by Ethereum. We have seen that these crypto-coins also have a visible differences in their respective investor community with Ripple being popular among the young crowd and Bitcoin Cash among the older traders. It is thus only fair to claim that the trend of average profitability of these digital assets can also be extrapolated to the age groups of these investors.

Also Read:

https://blog.unocoin.com/buying-your-dream-home-with-ethereum-d33a5b6daeb8