The Genesis of Bitcoin

Bitcoin’s genesis can be traced back to a white paper published in October 2008 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. Titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” the paper presented the concept of a decentralized digital currency that would enable secure peer-to-peer transactions without the need for intermediaries such as banks. Nakamoto’s breakthrough was blockchain, the distributed ledger technology that would underpin Bitcoin and future cryptocurrencies.

In January 2009, Nakamoto mined the first ever Bitcoin block, known as the “genesis block”. This marked the birth of the Bitcoin network, and Nakamoto continued to contribute to its development before finally disappearing from the public eye in 2010. This enigmatic figure left the foundation for a financial revolution, and over the next decade, Bitcoin’s journey evolved into a global phenomenon.

An unleashed global phenomenon

Bitcoin’s rise since its inception has been marked by several key milestones. It initially gained the attention of a narrow community of crypto enthusiasts and libertarians who saw it as a potential alternative to traditional financial systems. In the early days, the value of Bitcoin was practically negligible and it was primarily used for experimental transactions within this niche group.

However, as its usefulness and scarcity became apparent, Bitcoin began to attract wider interest. In 2010, the first real-world transaction occurred when a programmer named Laszlo Hanyecz famously bought two pizzas for 10,000 BTC, now considered one of the most expensive pizzas in history. The event marked the first time Bitcoin was used as a medium of exchange for physical goods.

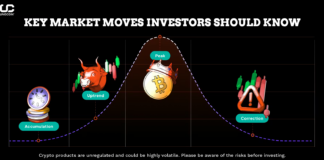

In the years that followed, Bitcoin’s value experienced extreme volatility, but it also gained legitimacy and acceptance. By 2013, the price of Bitcoin climbed above $1,000 for the first time, attracting the attention of investors and mainstream media. This led to the emergence of cryptocurrency exchanges and an influx of institutional interest.

2017 saw a remarkable bull run, with Bitcoin hitting an all-time high of nearly $20,000. This rally has been driven by increased awareness, speculation and a wave of initial coin offerings (ICOs) that have spawned a number of new cryptocurrencies and blockchain projects. However, the subsequent market correction underscored the need for regulatory scrutiny and risk management in the cryptocurrency space.

Bitcoin’s journey continued into 2020 when it faced a major test in the form of the COVID-19 pandemic. While traditional markets have plummeted, bitcoin has proven its resilience as a digital store of value, attracting investment from institutional players looking to hedge against economic uncertainty. This newfound institutional interest marked a turning point that led to greater recognition and acceptance of Bitcoin as a legitimate asset class.

In 2021, Bitcoin broke new ground by reaching a price of over $69,000, thanks in large part to institutional investment and growing acceptance among large corporations like Tesla and Square, which began adding Bitcoin to their balance sheets. This confirmation from corporate giants further cemented Bitcoin’s status as a global phenomenon and store of value.

Conclusion:

In conclusion, Bitcoin’s journey from its inception to becoming a global phenomenon has been remarkable. It started as an obscure concept in a whitepaper and has evolved into a digital asset with a market cap in the trillions of dollars. Along the way, it has faced challenges, skepticism and regulatory oversight, but has also gained widespread recognition and acceptance. As Bitcoin continues to shape the financial landscape, its future remains exciting and uncertain, with the potential to fundamentally reshape global finance.

Please find the list of authentic Unocoin accounts for all your queries below:

- YouTube Channel: https://www.youtube.com/c/Unocoin/videos

- Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Instagram: https://www.instagram.com/unocoin/

- Twitter: https://twitter.com/Unocoin

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- E-mail id: [email protected]

- Contact details: 7788978910 (09:30 AM IST – 06:30 PM, Mon – Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer: Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).