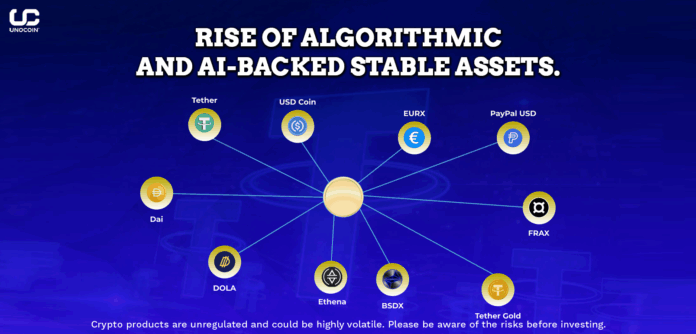

Stablecoins have long been the backbone of the crypto economy, serving as a bridge between volatile digital assets and the stability of fiat currencies. For years, USDT (Tether) and USDC (USD Coin) have dominated this space, offering dollar-pegged tokens backed by reserves. However, the future of stable assets goes far beyond simple fiat-backed tokens. The next generation of innovation is already here: algorithmic stablecoins and AI-powered stable assets are redefining how value is stored and transferred in Web3.

The Limitations of Traditional Stablecoins

USDT and USDC have proven essential for trading, payments, and DeFi liquidity. Yet, both rely heavily on centralised structures—backed by fiat reserves held in traditional banks. This raises two critical concerns:

- Centralisation Risk – Regulatory crackdowns or banking restrictions could affect access and redemption.

- Transparency Questions – While USDC publishes audits, debates over reserve quality in some stablecoins remain unresolved.

As blockchain adoption grows globally, demand is rising for stable assets that are decentralised, adaptive, and resilient.

Algorithmic Stablecoins: Decentralisation First

Algorithmic stablecoins attempt to maintain their peg using code instead of collateral. Through supply and demand mechanics, smart contracts automatically expand or contract token supply to stabilise prices.

Notable examples include:

- DAI – Backed by crypto collateral on MakerDAO, it pioneered decentralised stability.

- FRAX – Uses a hybrid model, part-collateralised and part-algorithmic.

- UST (Terra) – Despite its collapse in 2022, it highlighted both the potential and risks of purely algorithmic systems.

The lesson from past failures is clear: algorithmic models need stronger risk frameworks and diversified collateral to survive extreme volatility. Developers are now building second-generation protocols that combine decentralisation with sustainability.

AI-backed Stable Assets: The Next Leap

The latest frontier is AI-integrated stablecoins, where artificial intelligence helps manage reserves, risk exposure, and market interventions. Imagine a stablecoin that:

- Monitors global economic data in real time,

- Predicts liquidity shocks before they happen,

- Automatically rebalances collateral baskets, and

- Adjusts peg strategies dynamically based on macroeconomic signals.

Such smart stablecoins could be more adaptive than static reserve models, reducing risks of de-pegging while maintaining transparency on-chain. AI-powered models are already being tested by fintech startups, merging blockchain with predictive algorithms.

Why India Should Watch This Space

India is emerging as one of the largest markets for digital payments and crypto adoption. Stablecoins already play a major role in remittances, trading, and hedging against volatility. With algorithmic and AI-backed stable assets, Indian users could soon see:

- Cheaper Cross-border Transfers: Reducing reliance on expensive remittance channels.

- Smart Savings Products: AI-managed stablecoins offering risk-adjusted yields.

- Decentralised Rupee Alternatives: Assets pegged to INR or a basket of currencies for local use cases.

The Road Ahead

Stablecoins are no longer just “crypto dollars.” The industry is shifting towards smart stable assets that combine decentralisation, innovation, and intelligence. While USDT and USDC will remain pillars, the rise of algorithmic and AI-backed models signals a more resilient and adaptive future for digital money.

For Indian investors and businesses, this evolution could mean new opportunities in payments, trading, and digital finance—unlocking a smarter, more inclusive financial ecosystem powered by Web3.

Please find the list of authentic Unocoin accounts for all your queries below:Twitter: https://twitter.com/Unocoin

Telegram Group: https://t.me/Unocoin_Group

Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

E-mail id: [email protected]

Other links: linktr.ee/unocoin

Contact details: 7788978910 (09:30 AM IST – 06:30 PM, Mon-Sat)

App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer: Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests, as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).