Have you come across the term “crypto products” (assets, coins, tokens, NFTs) before? Are you aware of the significance of market capitalisation? If you answered yes, you are on the right blog. This article will take you through the definition of market cap, its significance for investors and some frequently asked questions around it. For stock market investors, market capitalisation is an important consideration. For crypto investors, though, the situation is different.

While stock market capitalisation — the total amount of a company’s total shares of stock — can aid in the development and maintenance of a well-balanced investment portfolio, experts claim that the same guidelines do not apply to crypto investors.

You will learn more about market capitalisation in this article. You will also gain the most recent information on bitcoin market cap history. So if you are willing to know more about it, give this piece of writing a quick read.

What is the Market cap?

The overall worth of crypto products is known as its market capitalisation. While stock market capitalisation is derived by multiplying the value of a share by the number of shares available, the crypto products market cap is derived by calculating the price of crypto products by the number of coins in circulation.

To illustrate, the market capitalisation of bitcoin market share is calculated by multiplying the total number of coins in circulation (over 18 billion) by the value of bitcoin market cap history at the moment. Bitcoin’s market capitalisation swings as its price fluctuates, which it regularly does. Bitcoin’s price has fluctuated between $45,000 and $64,000 in recent weeks, resulting in a substantial market capitalisation range:

- $45,000 x 18.8 million = $846 billion

- $55,000 x 18.8 million = $1.034 trillion

Here’s how the Ethereum market cap contrasts with Bitcoin Market Cap in market capitalisation. Ethereum market cap has a market valuation of roughly $351 billion, with a price of 3,000 Dollars and a circulation of about 120 million coins. Although there are more Ethereum coins, bitcoin’s market valuation is higher.

Unocoin is India’s first foray into the bitcoin market cap industry, having launched in July 2013. Indians may now purchase, sell, store, use, and accept bitcoin through the firm. Unocoin’s unshakable goal is to become a leading global crypto-assets player and contribute to the Indian and international economies.

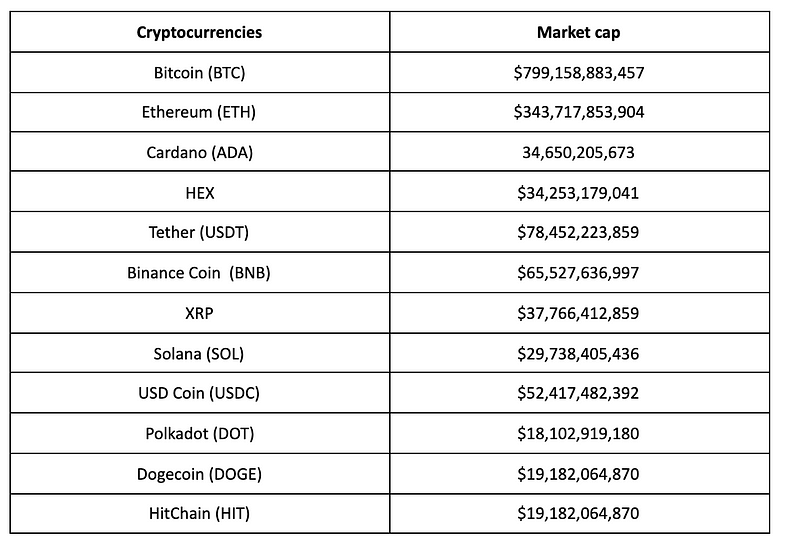

Top cryptocurrencies by market cap

Crypto market cap and investors

Determining a company’s market capitalisation in the stock market assigns it to one of three investment categories: small-cap, mid-cap, or large-cap. Knowing the market cap is crucial because an investor may divide their investment into various groups for various reasons. Large-cap equities are less hazardous than mid- or small-cap companies, developing more slowly.

Crypto products, on the other hand, is a relatively new concept. These categories have yet to be developed because the technology is so unique. And, since experts recommend sticking to Bitcoin and Ethereum and not letting crypto account for more than 5% of your whole portfolio, there’s less of a need to consider market cap when making investing decisions.

Knowing the market capitalisation of crypto products is helpful if you want to understand the breadth of the potential of a particular token. Still, it shouldn’t play as significant a role in your investment decisions as it does in the stock market. It’s critical to understand that crypto products are not the same as the stock market.

Bitcoin: What are the advantages of using it?

The bitcoin network has dominated and even defined the virtual currency space since its founding in 2009, initiating a legion of altcoin fans and serving as a substitute to state fiat currencies like the U.S. dollar or the Euro, as well as pure commodity currencies like gold and silver coins for some users.

Part of Bitcoin’s allure to these advocates is its decentralised nature, in which it is not overseen or regulated by a central authority. This sets it apart from fiat currencies, backed by the government and issued by central banks.

Unlike conventional cash, Bitcoin is not generated by a national bank or government. Instead, a device mines bitcoin by tackling mathematical riddles or algorithms and checking transaction blocks before adding them to the network. Bitcoin can also be bought with conventional national currencies and held in a bitcoin account, retrieved from a smartphone or computer.

We can better comprehend how bitcoin market share gives possible benefits to its users now that we’ve seen a summary of what bitcoin is:

- It has customer’s autonomy

Traditional fiat currencies are subject to a multitude of restrictions and threats. Banks, for example, are susceptible to booms and busts in the economy. These circumstances can sometimes culminate in bank runs and crashes, as they have in the past. This means that users’ funds are not entirely under their control.

Because Bitcoin’s price is unconnected to specific government acts, it protects user autonomy, at least in theory. This indicates that consumers and holders of the bitcoin market cap have total control over their funds.

- The transactions are anonymous

Most internet transactions require a slew of data to identify the individual executing the trade. Transferring money from one person to another, for example, can only be done once both parties’ identifying information has been validated. Similarly, making an online transaction necessitates entering identifying information.

Although the verification procedure helps avoid crime, it also puts a mediator in command of the transaction, allowing them to regulate the distribution of services to specific parties.

Transactions in bitcoin are anonymous. While this does not make the transactions fully anonymous, they can only be traced back to a blockchain address. A person can have many addresses for a single account, just as various usernames and passwords. I.P. names or other personal information are not required for this transaction.

- These transactions are secure

Bitcoin is virtual money that does not exist in the real world. If an attacker has access to the wallet’s private keys, they can take a person’s bitcoin. With sufficient protection, however, stealing bitcoin is technically impossible. While crypto products exchanges have been hacked in the past, Bitcoin’s itself has remained unscathed. Transfers between two addresses are thus secure.

Investors use market capitalisation to present a complete story and compare the worth of crypto products. It could reveal a crypto products’ growth potential and whether it is safe to buy compared to other crypto products as a critical statistic.

To demonstrate how this works, consider the market capitalisation of two fictional cryptos:

- The market cap of crypto products A is $400,000, with 400,000 coins in circulation, each worth $1.

- The market valuation of crypto product B is $200,000 if it has 100,000 coins in production, and each coin is worth $2.

- Despite crypto products B’s coin price being higher than crypto products A’s, crypto products A’s aggregate worth is double that of crypto products B.

It’s also worth noting that the market capitalisation of several crypto products can swing substantially

because of their volatility.

Role of market capitalisation

Some traders and investors, particularly amateurs, may misinterpret a stock’s price to accurately depict its value, strength, or stability. They may see a more excellent stock price as a sign of a company’s solidity or a lower price as a good deal on an investment. The value of a corporation is not determined solely by its stock price. The correct metric to use is market capitalisation, as it represents the genuine value as viewed by the entire market.

Microsoft had a market valuation of $814 billion in 2018, with an asset value of $101.16 per share, whereas IBM had a total value of $130 billion, with an asset value of $142.69 per common stock.

Comparing the two companies purely based on their stock prices would not accurately reflect their genuine relative values.

A large-cap corporation with a billion-dollar valuation may have more room to invest a few hundred million dollars in a new line of business and not take a massive blow if the endeavour fails. A mid-cap or micro-cap business making a similar value investment, on the other hand, maybe vulnerable to significant losses if their attempt fails since they lack the larger cushion to absorb the loss. If the effort succeeds for large-cap corporations, the profit numbers may appear minor.

However, if the company’s success is scaled up, it might result in much bigger earnings. The success of such endeavours, on the other hand, can boost a mid-cap company’s worth to new heights.

When there are reports of a large-cap firm intruding on a mid-cap or small-cap company’s space of products or services, valuations of mid-cap or small-cap companies often take a knock. For example, Amazon’s foray into cloud hosting services under the Amazon Web Services (AWS) umbrella has posed a significant threat to smaller specialist enterprises.

Market capitalisation data are also used to create a variety of market indices. The S&P 500 index, for example, is a benchmark stock index that contains the top 500 U.S. businesses ranked by market capitalisation. In contrast, the FTSE 100 index includes the top 100 companies listed on the London Stock Exchange with the largest market capitalisation. These indexes are used as benchmarks to track the success of various funds, portfolios, and individual investments and represent broader market developments and attitudes.

How can you utilise the market cap?

Market capitalisation allows you to compare the overall worth of one crypto product to that of another, allowing you to make better investing decisions. Based on their market capitalisation, crypto products are split into three categories:

- Large-cap cryptos, such as Bitcoin Market Cap and Ethereum, have a market value of more than $10 billion. Buyers perceive them to be relatively low-risk investments because they have a demonstrated track record of growth and often have higher liquidity. This means they can withstand a higher volume of consumers paying out without lowering the pricing much.

- Mid-cap blockchains have market capitalisations ranging from $1 billion to $10 billion, and they’re regarded to have more undiscovered upside potential and more dangerous.

- Small-cap altcoins, defined as those with a market valuation of less than $1 billion, are the most susceptible to market mood shifts.

Market capitalisation is a good metric for determining the total value of cryptos. Still, you must also evaluate market trends, crypto products’ stability, and your financial situation when calculating the risks of any investment.

Final words

Size does indeed matter in the world of investing. Individual stock investors and investors in various funds need to understand the market cap notion. Market capitalisation can assist investors in determining where they should invest their hard-earned money.

While metrics like market cap are crucial to know when investing, one of the first fundamental steps is to open a brokerage account. With such a wide range of costs and features, picking a broker might be a little intimidating.

FAQs

1. Does the market cap change every day?

To put it in another way, the market cap changes as the Asset price changes. The Asset price varies virtually every second when the market is open, leading to the recent market cap changes. The market cap does not change if the asset price does not change.

Unocoin is India’s first and the most secure bitcoin trading app. This exchange app was founded in 2013. You can buy and sell bitcoin instantly using the Instant Buy and Sell feature. Not just this, you can also buy ETH and Sell ETH in no time. With more than eighty-seven coins listed on this best cryptocurrency exchange in India, you can also accept bitcoin from your friends from any location. You can also know which cryptocurrency works best for you with the price ticker and notifications. The most popular cryptocurrencies like Bitcoin (BTC), Ether (ETH), USDT (Tether), BNB, Ripple (XRP), Cardano (ADA), Solana (SOL), Binance USD (BUSD), Dogecoin (DOGE), Polkadot (DOT) and other popular altcoins can be traded on the go. The new Android and iOS applications make Unocoin the best cryptocurrency app. With the unique feature of the Systematic Buying Plan, you can buy and sell bitcoin and Ether periodically. What more? You can start your crypto journey using SBP for as little as INR 10. With another exciting feature called Crypto Basket, you can diversify your crypto portfolio based on market capitalisation (Market Cap) or Volume. These two excellent features make Unocoin the best cryptocurrency platform.

Love Crypto Coins. Love Unocoin.

Please find the list of authentic Unocoin accounts for all your queries below:

- YouTube Channel: https://www.youtube.com/c/Unocoin/videos

- Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Instagram: https://www.instagram.com/unocoin/

- Twitter: https://twitter.com/Unocoin

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- Contact details: 7788978910 (09:30 AM IST — 06:30 PM, Mon — Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer:

Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).