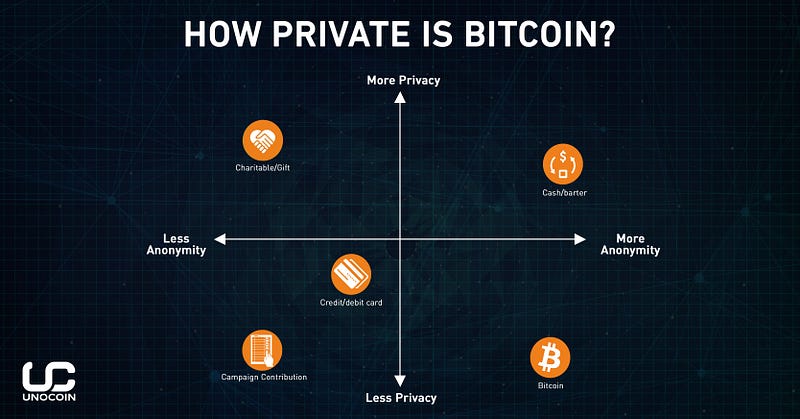

Bitcoin has always been described as an anonymous payment network. However, in reality, bitcoin is actually one of the most transparent payment systems on the planet. Sounds conflicting? Is Bitcoin really as private as we think it is?

Before we delve deeper, it is important to grasp the difference between privacy and anonymity, as there is a tendency for the two to overlap in our understanding.

Anonymity vs. Privacy

Anonymity refers to ‘unknown authorship or origin’. In other words, Bitcoin transactions would be considered anonymous if no third party knew about the transaction executor.

On the other hand, privacy here refers to ‘not being known or intended to be known publicly’. A Bitcoin transaction would be seen as private if no third party knew had access to transaction details such as purpose and amount.

The difference needs to be kept in mind because Bitcoin transactions are usually anonymous, but are not private. Identities are not recorded in the Bitcoin blockchain itself. But every confirmed Bitcoin transaction is permanently etched and is visible in its blockchain.

Bitcoin Traceability

While the identities itself are not stored in the blockchain, the addresses of the wallets are. These addresses are used by the network to locate where they are sent. Since all transactions are broadcast to the public in the Bitcoin blockchain, the public can view the flow of Bitcoins from one address to another. This level of transparency of the Bitcoin consequently allows the Bitcoin transactions to be tracked as well as traced and is essential for bitcoin to succeed as a decentralised currency, as everyone on the network can verify transactions.

Since most users access Bitcoin through portals that require them to reveal their identities (via processes such as KYC), their activities can be linked to their identities by law enforcement agencies if required. Of course, the agencies would need a good reason for this.

For many Bitcoin users who use the currency through online wallets or exchange services, their participation at the outset includes linking their personal identity to their Bitcoin holdings. And at this point, Bitcoin becomes no more anonymous than any usual bank account. Again, this is only for law enforcement and not the public at large.

“If you give anyone your bitcoin address, then everyone all over the globe can find out what the balance in that wallet is,” says Sharan Nair, Vice President — Marketing and Communications at Unocoin. Emphasising on not to give out your address — since it is important to note that nobody can associate the bitcoin wallet with you unless you specify it.

Transaction Ledger

There is no limit to the number of addresses that a Bitcoin holder can control. All Bitcoins can be stored in a single wallet or can be distributed into many wallets. This abundance of wallets makes it difficult to track the flow of funds controlled by a person. For example, if you’re storing your bitcoins on Unocoin (which is India’s first bitcoin exchange, by the way) — there is no one single address that will be assigned to you. So determining your balance will be difficult for any third party.

Irreversible Transactions

Transactions that occur with bitcoins are irreversible. Unlike cash, a bitcoin payment requires third-party verification. This happens over a global peer-to-peer network of participants, which validates and certifies all transactions on the blockchain. So each network participant is required to maintain the entire transaction history of the system. Therefore, bitcoin identities can be considered pseudo-anonymous, in the sense that even though they are not explicitly linked to specific individuals or organizations, all transactions are completely transparent.

What can be done?

The fact that all transactions are permanently recorded and announced publicly should be a constant reminder to the users that Bitcoin is certainly less anonymous than cash. At the same time, it much more ‘private’, since you’re never going to have to be physically present during a bitcoin transaction. You’ll be doing them online.

However, there are improvements that are coming up in the works that could focus on Bitcoins’ privacy and anonymity. One such example is bitcoin tumblers — which take your coins, mix it up with their own, and then disperse those for payment. So those coins can not be traced back to you.

As bitcoin adoption continues to rise, a question does arise — will a technology race arise amongst the anonymizers and the de-anonymizers? On the one hand, increasingly refined data mining schemes will be developed to trace the movement of funds in the blockchain between individuals and across the borders. However, on the other hand, improved techniques will also be formulated to conceal individual identities and activities.

Also Read:

https://blog.unocoin.com/what-are-cryptocurrencies-9011af463484

![Fundamental Analysis in Crypto [Updated Guide] A Comprehensive Guide to Asset Valuation.png](https://blog.unocoin.com/wp-content/uploads/2024/11/A-Comprehensive-Guide-to-Asset-Valuation-218x150.png)