The advent of modern technologies around blockchain and digital currencies has opened the avenue up to innovative governance models. The US Dollar, printed by the United States Mint with permission from the United States Congress is legit and worth its value because it is backed by the United States government.

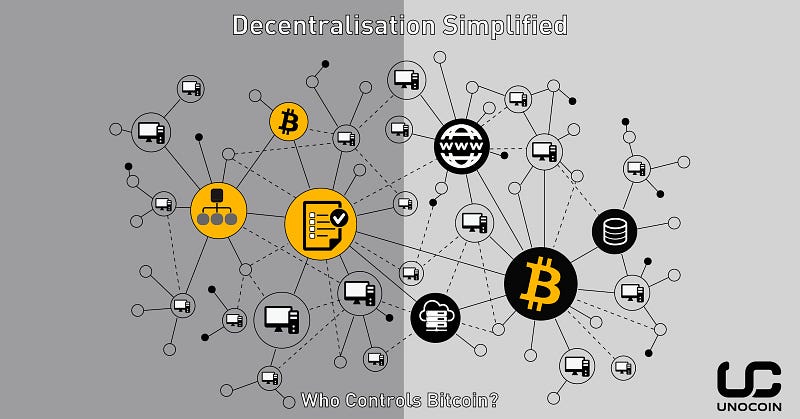

However, in the absence of the government, the value of the US Dollar would sink as there would be no entity maintaining the value of the currency. On the other hand, the peer-to-peer network of digital currency, Bitcoin does not rely on a central authority. Bitcoin, the first crypto-currency based on blockchain technology, was created as a peer-to-peer payment network that provides its users the flexibility to transfer value without the involvement of a central authority or third-party owner. This concept of redistributing or dispersing functions, powers, people or things away from a central location or authority is called decentralization.

Why is Decentralisation vital to Bitcoin?

Any node of the P2P network is not solely responsible for the respective blockchain. Bitcoin works on the key fundamental that as long as each peer is connected to a single peer telling the truth, even if every other is lying, the chain continues. Relying on trusted entities for determining the truth removes the onus from any individual entity. Centralized systems can easily be censored. Censoring transactions allow third parties to prevent the flow of transactions to or from certain sources.

While governments form a significant censorship framework, any system that depends on centralization, is equally threatened by any controlling-entity of the network. Decentralized networks on the other hand, “pure P2P networks like Gnutella and Tor seem to be holding their own” as per Satoshi Nakamoto, the creator of Bitcoin.

In addition to this, centralized systems can facilitate easy seizure of massive amounts of funds from its users. Banks, for example, can take your funds under legal circumstances. However, Bitcoin users might face some attacks that can be mitigated using time-locked transactions or multi-signature transactions. Decentralized networks ensure that no entity can compel a third-party to release an individual’s funds to them without his/her permission, unlike every centralized financial system.

While a centralized network is vulnerable to accesses being blocked by ISP, government, or other authority, decentralized networks like Bitcoin are incredibly resilient to this type of attack. In the rare situation of the Internet being completely shut down, Bitcoin can sustain itself using communication through satellites or shortwave radio. Since there is no single point to shut the network down, one would have to eliminate every node to kill Bitcoin entirely.

The Solution Design of Decentralisation

Bitcoin’s core innovation design lies in its decentralized structure. It has no central controlling organization or central repository of information. Without a central management or central point of failure for growth, Bitcoin stands strongly decentralized. While most of the actual services and businesses built within the Bitcoin ecosystem are run by specific people, in specific locations, with specific computer systems, the power is distributed across these nodes.

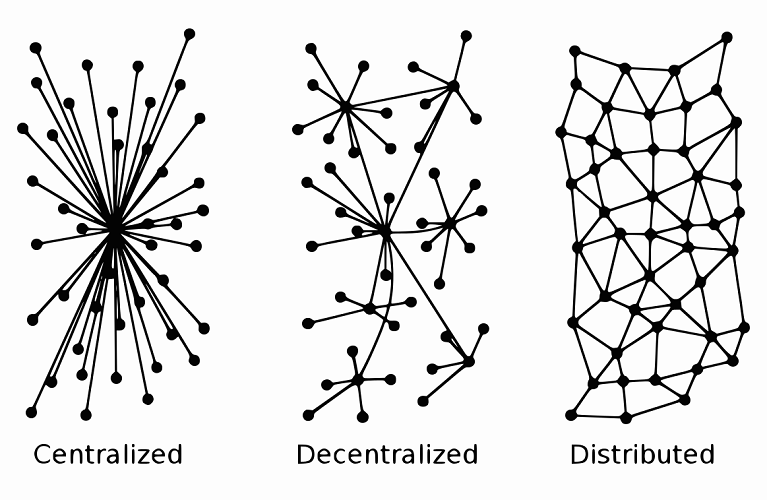

It is important to note that there is a fundamental difference between distributed networks and decentralized networks. While a ‘distributed computing network’ is very robust, decentralized systems like Bitcoin closely resemble a decentralized network and allow network members to participate at all levels. Levels of participation in the forum vary from huge server farms to printed-out private keys and everything else in between. This network is strengthened by allowing every user to participate at the level that suffices his inclination and his capability. Participants who specialize and master the pursued skill set can pull Bitcoin towards becoming the best version of itself.

The downsides to Decentralization

While the concept of decentralizing financial frameworks sounds conducive for our evolving needs, there are a few reasons people still favor centralized networks.

Some decentralized frameworks like Bitsquare require users to be logged online for an order to be listed and for completing the trade. This requires users to perform certain actions like signaling when a payment was received.

Despite the challenges, it is likely that some people’s faith in Bitcoin and any decentralized currency will be strengthened over time. Decentralization can be a stepping stone towards distributing power from big institutions to everyone else. It is one of the selling points about Bitcoin and a catalyst in reorganizing the world operations.

Also Read:

https://blog.unocoin.com/how-private-is-bitcoin-cc55734b3d7a