Mastering Crypto Analysis: Top Techniques & Strategies for Trading Futures

The cryptocurrency market, characterized by its volatility and constant fluctuations, presents both opportunities and risks for traders. To thrive in this dynamic environment, it is essential to master the art of crypto analysis. By examining price data, market sentiment, and key indicators, traders can create solid strategies that help them capitalize on market movements. This blog will explore the fundamentals of crypto analysis, comparing technical and fundamental analysis, and delving into advanced trading strategies like leverage, margin trading, and algorithmic trading.

Understanding the Basics of Crypto Analysis:

The crypto analysis involves examining various factors that impact the price of a cryptocurrency. There are two primary approaches to this:

- Technical analysis involves studying past price data, chart patterns, and technical indicators to identify trends and predict future price movements.

- Fundamental analysis: This focuses on evaluating the core factors affecting a cryptocurrency’s value, including the project’s team, technology, usage, competition, and overall market conditions.

Both approaches are essential for making informed investment decisions, and understanding these basics is key to navigating the crypto market successfully.

Technical vs. Fundamental Analysis: A Comparative Overview

While technical analysis relies on historical price data to predict future price movements, fundamental analysis looks at the intrinsic value of a cryptocurrency.

- Technical analysis is grounded in the belief that price movements are not random but follow identifiable patterns over time. Traders use charts and technical indicators like moving averages and the Relative Strength Index (RSI) to spot trends and predict potential outcomes.

- On the other hand, fundamental analysis examines the project’s underlying factors, such as the team’s expertise, technological innovations, adoption rates, and competition. Fundamental analysts believe that a cryptocurrency’s price will reflect its true value over time.

Combining both technical and fundamental analysis allows traders to gain a comprehensive understanding of market dynamics and make well-rounded trading decisions.

Diving into Technical Analysis:

Technical analysis plays a crucial role in crypto trading by helping traders read price charts, identify trends, and make informed decisions. This approach involves studying historical price data to understand market sentiment and anticipate future price movements. Key tools for technical analysis include candlestick, line, and bar charts, as well as chart patterns such as head and shoulders, triangles, and double tops/bottoms.

Reading Crypto Charts:

Understanding how to read charts is vital for technical analysis. The three most common types of charts are:

- Line charts: These are the simplest charts, connecting closing prices to illustrate overall price trends.

- Bar charts: These provide more detailed information by displaying the opening price, closing price, highest price, and lowest price for each period.

- Candlestick charts: These are popular due to their visual appeal and easy-to-read format. Each candle represents price changes over a given period, with green indicating price increases and red showing declines.

Mastering the interpretation of these charts is a cornerstone of successful crypto trading.

Identifying Key Chart Patterns:

Recognizing chart patterns is an essential skill in technical analysis. Some common patterns include:

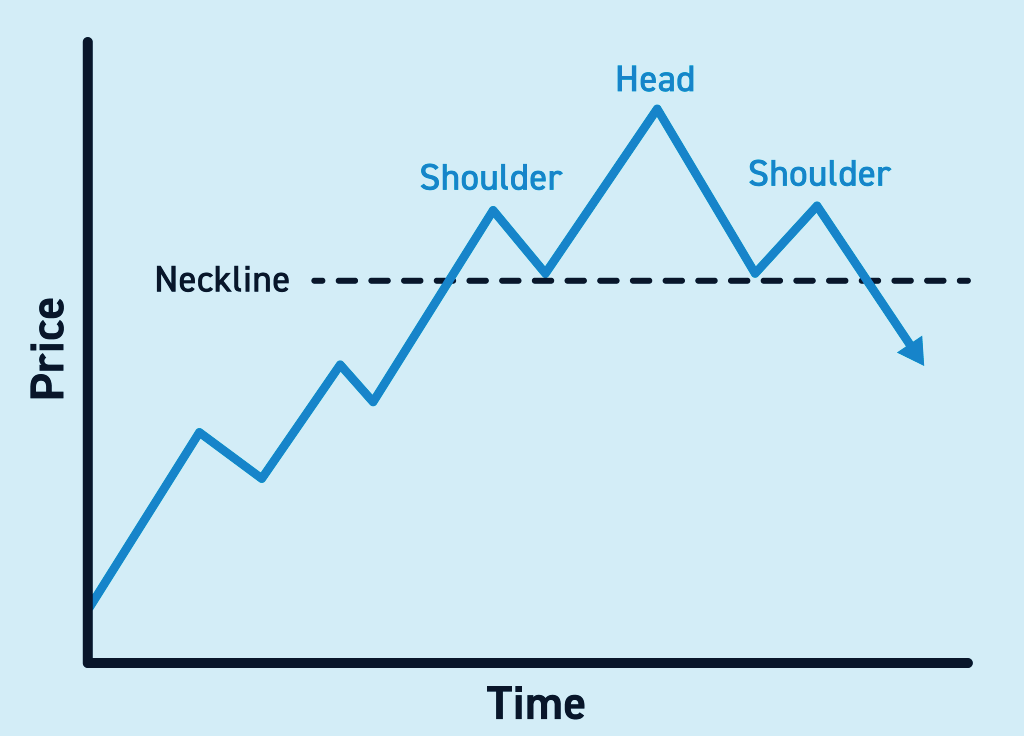

- Head and Shoulders: This signals a bearish reversal, typically appearing after an uptrend, indicating a slowdown in price increases.

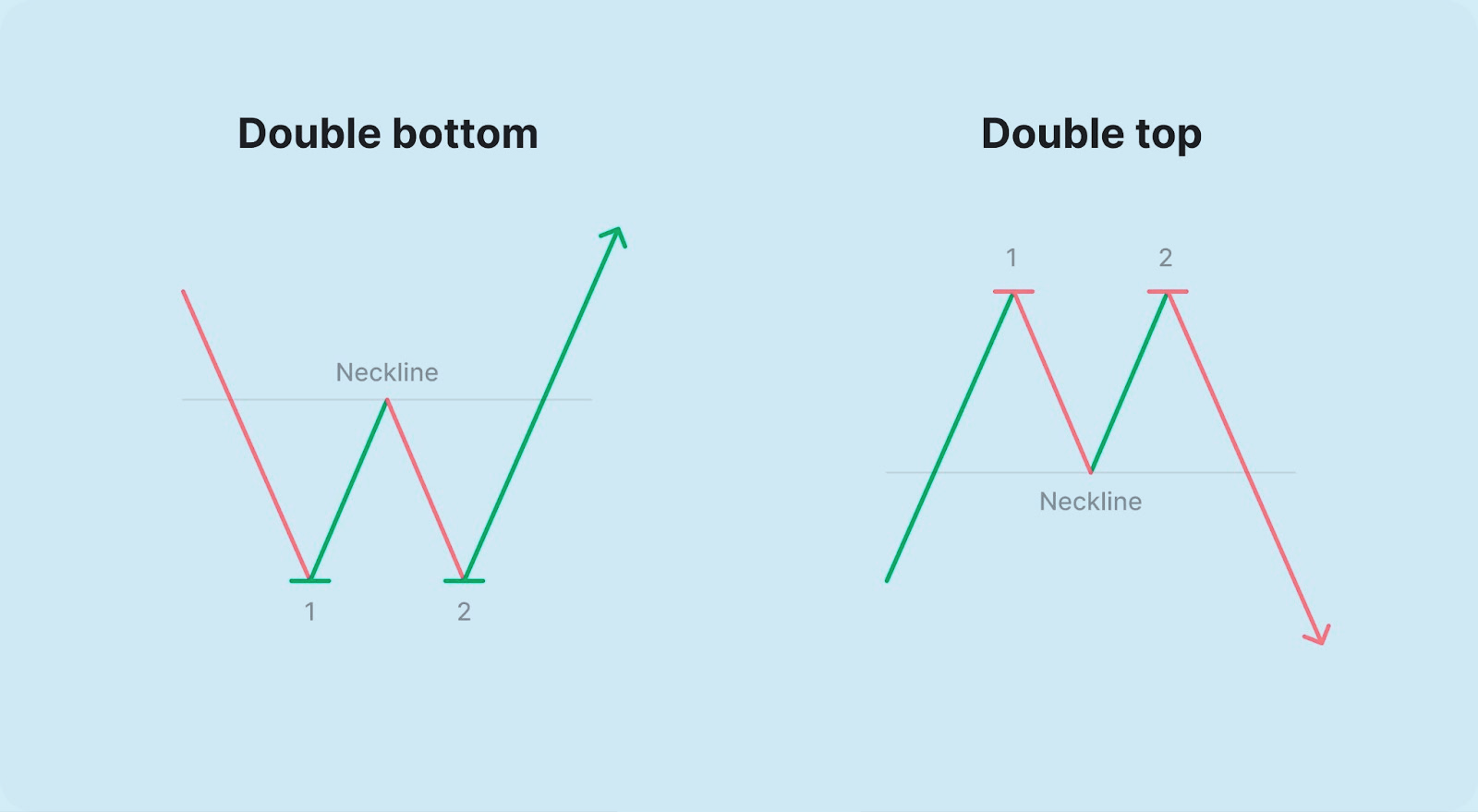

- Double Tops and Bottoms: A double top suggests a shift from a bullish to a bearish trend, while a double bottom indicates a potential move from bearish to bullish.

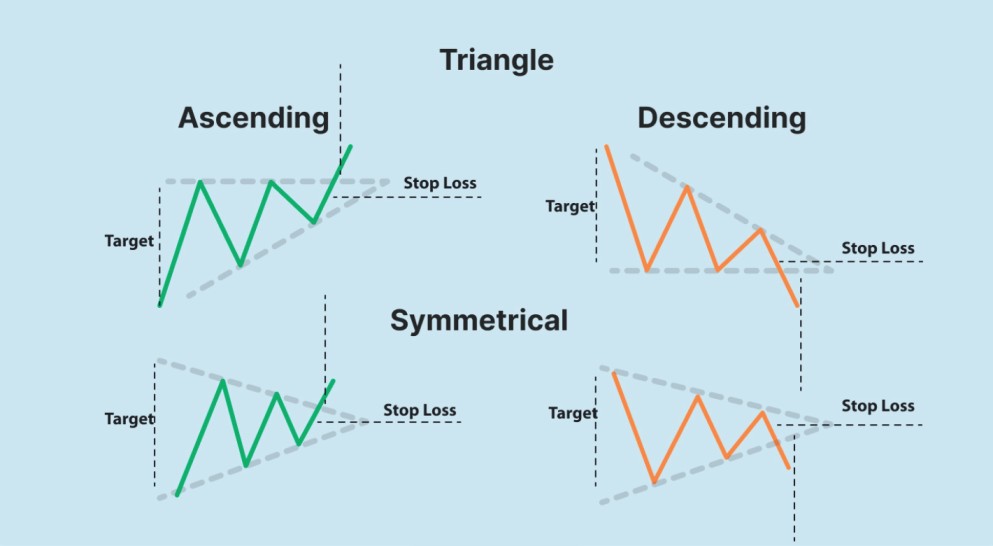

- Triangles: These are continuation patterns, suggesting that the current trend will continue after the pattern is completed.

By learning to spot these patterns, traders can make better-informed decisions about when to enter or exit trades.

Fundamental Analysis in Cryptocurrency

While technical analysis focuses on price data, fundamental analysis examines the factors that influence a cryptocurrency’s value. Key elements of fundamental analysis include evaluating the project’s whitepaper, team experience, technology, community involvement, and market position.

Assessing Market Sentiment

Market sentiment reflects how investors feel about a particular cryptocurrency or the broader market. Positive sentiment, often driven by favorable news, new regulations, or technological advancements, can lead to price increases. Conversely, negative sentiment—triggered by scams, regulatory crackdowns, or declining interest—can cause prices to fall. Monitoring social media, news platforms, and online forums is crucial for understanding current market sentiment and making informed trades.

Evaluating Blockchain Project Fundamentals

When conducting a fundamental analysis of a blockchain project, it’s important to examine the whitepaper, team credentials, technology, and adoption rate. Additionally, assessing market cap, trading volume, liquidity, and partnerships offers valuable insight into the project’s long-term potential.

Core Indicators for Effective Crypto Analysis

Several technical indicators assist traders in identifying trends, momentum, and potential price reversals. Three widely used indicators include:

- Moving Average Convergence Divergence (MACD): This indicator examines the relationship between two moving averages to identify potential trend changes.

- Relative Strength Index (RSI): RSI measures the speed and magnitude of price movements, helping traders determine whether a market is overbought or oversold.

- Bollinger Bands: These are used to analyze price volatility. A price break above the upper band may signal an upward trend, while a break below the lower band suggests a potential downward trend.

Advanced Strategies in Crypto Trading

For seasoned traders, advanced strategies like leverage, margin trading, and algorithmic trading offer opportunities for higher profits—though with increased risk.

- Leverage and Margin Trading: These allow traders to amplify their positions using borrowed funds. While this can lead to higher gains, it also comes with significant risks.

- Algorithmic Trading: This involves using computer programs to automatically execute trades based on predefined rules. Algo-trading can quickly capitalize on short-term market movements, but it requires technical expertise and robust risk management.

Risk Management in Cryptocurrency Trading

Effective risk management is as important as identifying profitable opportunities in crypto trading. Setting stop-loss and take-profit points, diversifying your portfolio, and managing leverage are key components of a solid risk management strategy. By following these practices, traders can minimize potential losses and make more calculated decisions.

Conclusion

Mastering crypto analysis involves balancing technical and fundamental strategies to navigate the volatile cryptocurrency market. By understanding market sentiment, utilizing key indicators like MACD and RSI, and employing risk management techniques, traders can make informed decisions and increase their chances of success. Whether you’re a novice or an experienced trader, continually refining your analysis skills is essential for long-term profitability in the ever-evolving crypto world.

Please find the list of authentic Unocoin accounts for all your queries below:

- Twitter: https://twitter.com/Unocoin

- Instagram: https://www.instagram.com/unocoin/

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- YouTube Channel: https://www.youtube.com/c/Unocoin/videos

- Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- E-mail id: [email protected]

- Contact details: 7788978910 (09:30 AM IST – 06:30 PM, Mon-Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer: Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).

![Fundamental Analysis in Crypto [Updated Guide] A Comprehensive Guide to Asset Valuation.png](https://blog.unocoin.com/wp-content/uploads/2024/11/A-Comprehensive-Guide-to-Asset-Valuation-218x150.png)