January – March 2023: Preparing conditions for recovery

During the first quarter of 2023, the cryptocurrency market began to signal a departure from the previous bear market. The emergence of the bitcoin spot exchange-traded fund (ETF) story, highlighted by BlackRock CEO Larry Fink, played a vital role in the market’s recovery. Fink attributed the surge in Bitcoin (BTC) prices to a “flight to quality” amid prevailing uncertainty. This period set the stage for a more positive trajectory.

April – June 2023: Tokenization takes center stage

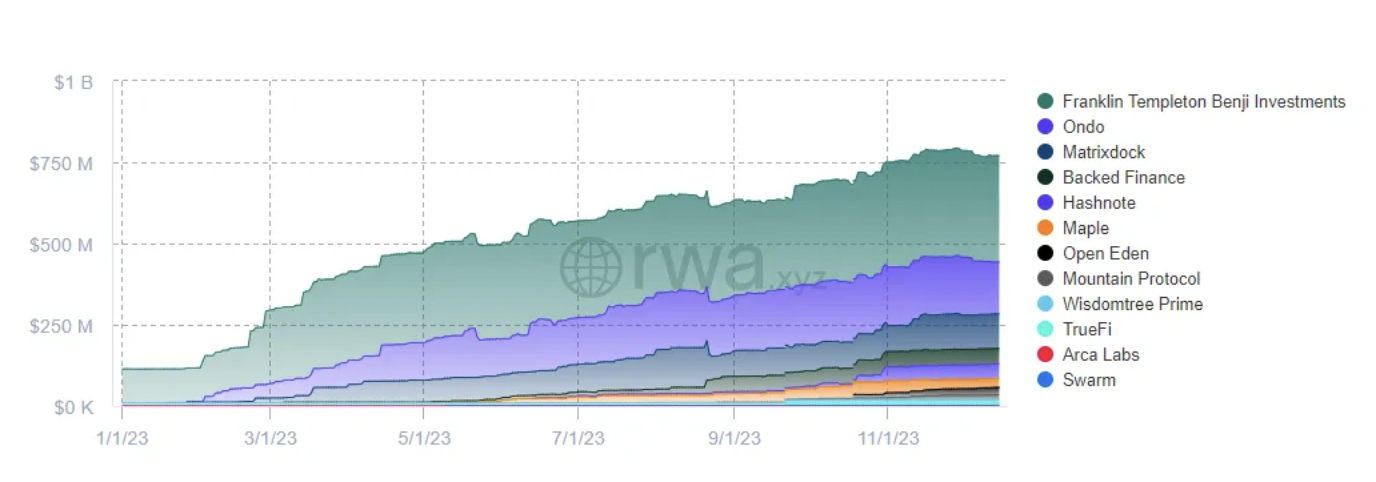

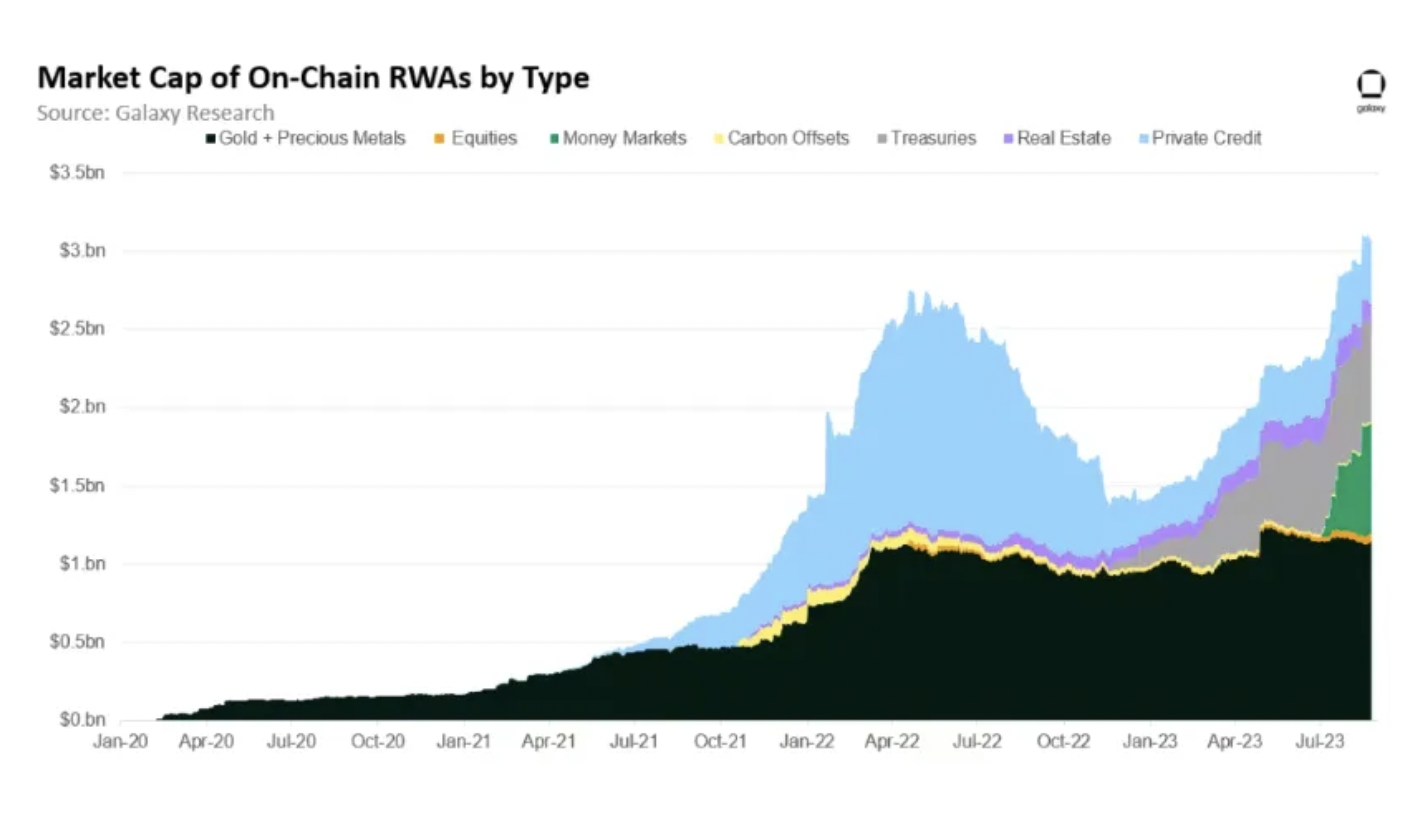

In the second quarter of 2023, real-world asset tokenization has established itself as a transformative technology. Major players in the banking and fund management sectors have actively experimented with tokenization.

Demonstrating a shift towards the convergence of traditional financial services and digital assets.

Euroclear, a major European clearing house, unveiled its tokenized securities issuance service, enabling the World Bank to issue a $106 million digital bond on the Corda blockchain.

July – September 2023: Notable Institutional Adoption and Challenges

In the third quarter, major institutional players such as JPMorgan, Franklin Templeton, Citi, ABN Amro and the EIB actively engaged in asset tokenization, contributing to the upward momentum of the industry. However, there were also problems, with MakerDAO facing liquidity problems and mismanagement.

Maple Finance lost funds from a bankrupt borrower, and Goldfinch experienced losses from a defaulting borrower. These challenges highlighted the experimental nature of the emerging field of real-world asset (RWA) tokenization.

October – December 2023: Growth amid risks and initiatives

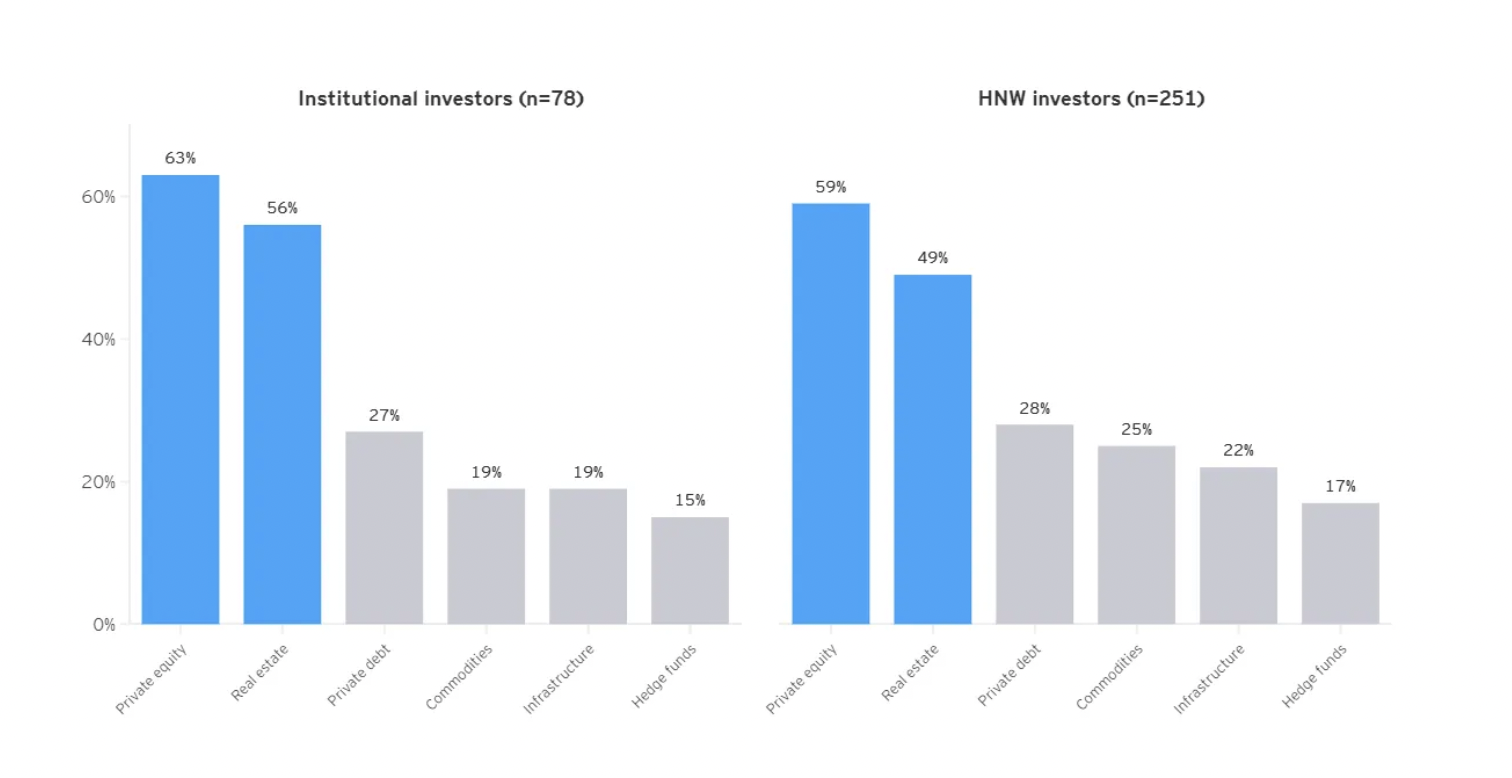

The last quarter of 2023 saw the continued growth of on-chain tokenization, with stablecoin issuers and DeFi protocols expanding their reach beyond the crypto space. Tangible’s partnership with Galaxy Digital to launch Real USD (USDR) on Polygon is an example of this trend. But challenges persisted, with legal and regulatory uncertainties remaining the main obstacle, as cited by nearly half of institutional investors in a survey conducted by EY-Parthenon.

January – March 2024: Brú Finance and the maturation of the crypto space

In the first quarter of 2024, Brú Finance emerged as a notable example of a DeFi protocol bridging the gap between capital seeking returns in developed countries and credit-starved emerging markets. Brú Finance’s asset-backed lending protocol has launched, serving underbanked communities and demonstrating the potential of decentralized finance. Government bond tokenization has gained momentum, and despite legal challenges, particularly in the US, regulatory tests in the UK, Singapore, Japan and Switzerland have focused on encouraging cross-border collaboration in asset tokenization.

April – June 2024: Future prospects and industrial cooperation

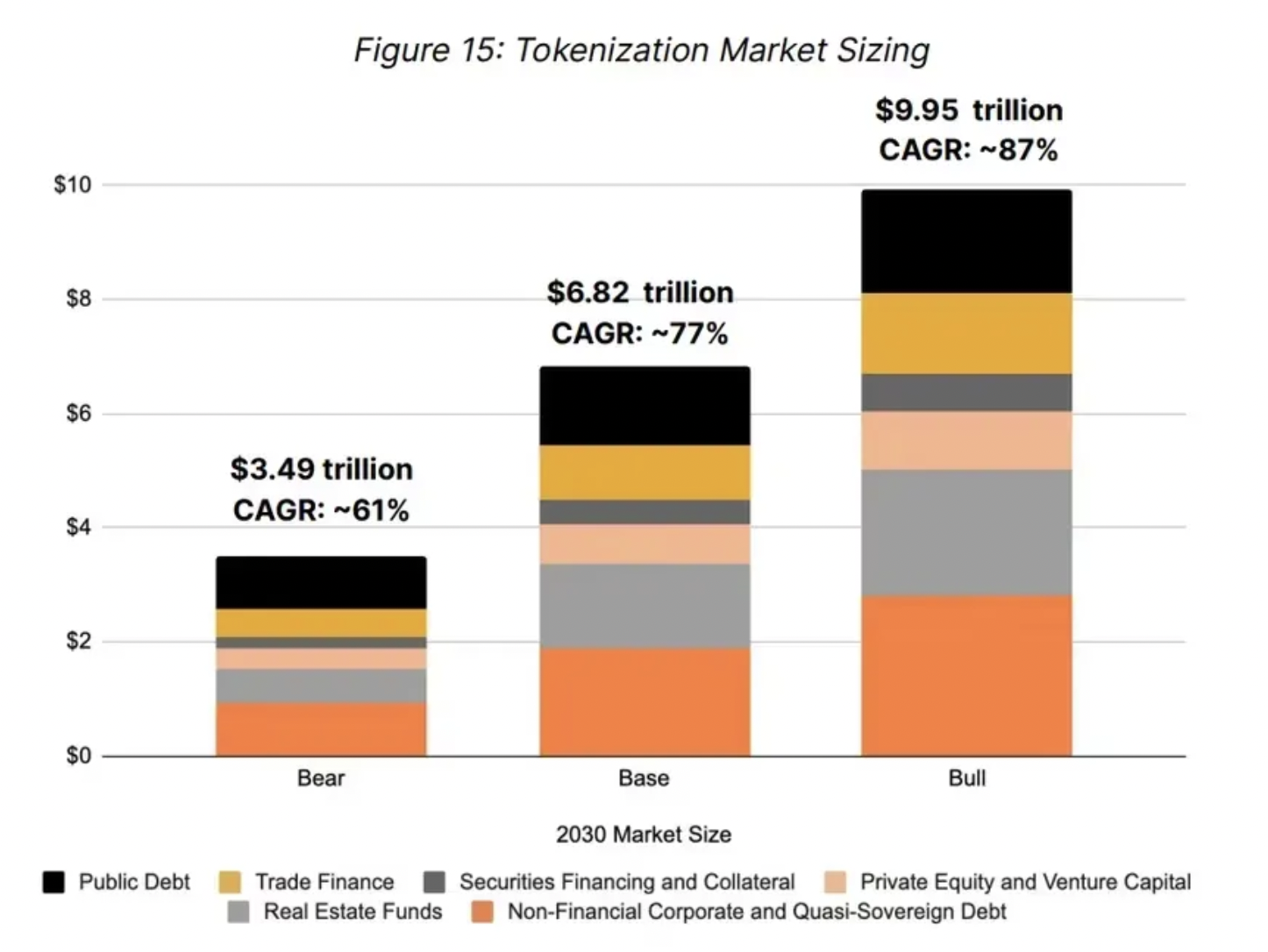

Looking ahead, the industry expects real-world asset tokenization to reach $10 trillion by the end of the decade. The formation of the Tokenized Asset Coalition (TAC) in early September 2023, composed of industry leaders, highlighted the commitment to advance public blockchains, asset tokenization and institutional DeFi. The crypto space is maturing, moving from frenzy to synergy, and is expected to increasingly integrate with existing financial software, bringing real assets into the chain through tokenization. Institutional thinking, regulatory cooperation and strong secondary market liquidity are identified as major factors for the continued growth and security of RWA tokenization.

Please find the list of authentic Unocoin accounts for all your queries below:

- YouTube Channel: https://www.youtube.com/c/Unocoin/videos

- Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Instagram: https://www.instagram.com/unocoin/

- Twitter: https://twitter.com/Unocoin

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- E-mail id: [email protected]

- Contact details: 7788978910 (09:30 AM IST – 06:30 PM, Mon – Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer: Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).