In this article, we’ll cover what is rebalancing and how you can easily do it using Passiv.

What Is Rebalancing?

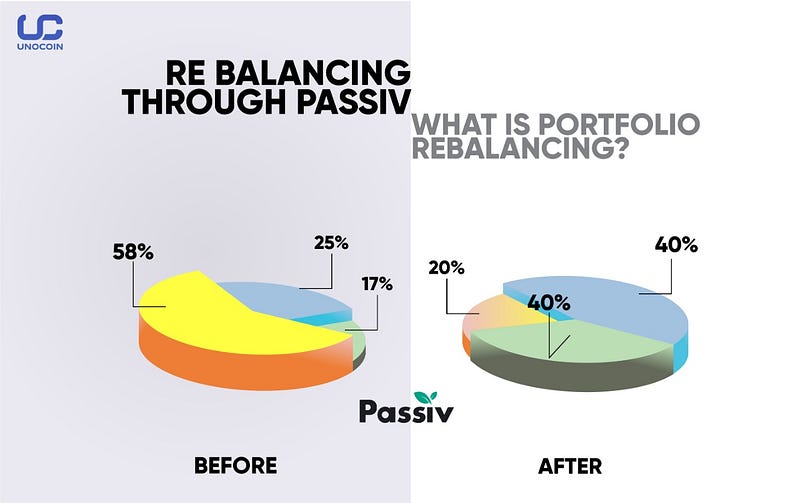

Rebalancing is a common investing strategy used by many investors to manage risk. To manage risk, investors spread the amount of money they plan to invest across a variety of assets. This is known as diversification and, in order to rebalance, you must first have an idea of what your asset mix or allocation should be. Once you’ve determined your ideal asset allocation, you’ll want to make sure that your portfolio maintains your allocation by buying and selling assets as the market moves.

For example, you might decide that your ideal asset mix is 50% Bitcoin, 30% Ethereum and 20% Tether. However, some time passes and your portfolio’s asset mix is no longer at that 50/30/20 ratio and that Ethereum now makes up 50% of your portfolio, as opposed to your intended 30% target. To bring your portfolio back in line with your original target, you have to sell some of your Ethereum and buy some Bitcoin and Tether.

By not rebalancing, you can find yourself in a situation where you are bearing too much (or little) risk than what you’re comfortable with.

When it comes to rebalancing, some investors prefer to purchase the underweight assets in their portfolio, as opposed to selling the top-performing ones to purchase those that are underperforming. This is because these investors believe that those assets that are currently performing will continue to perform and so they’d like to maximize their profits. So they use new cash to purchase the underweight assets and bring their portfolio back in line.

Regardless of your rebalancing strategy, Unocoin has partnered with Passiv to make it easier for their clients to manage and rebalance their crypto assets.

What is Passiv?

Passiv is a portfolio management tool that makes it easy to maintain a balanced portfolio. Users can build a model portfolio allocation and Passiv does all the work to help you maintain it. By default, Passiv will display trades that will help you to bring your portfolio back in line by purchasing the underweight assets in your portfolio. If you’d like to sell your overweight assets to purchase underweight ones, you can adjust the settings to do this. With Passiv, you have more flexibility and control.

The best part is, Passiv supports both traditional and cryptocurrency assets so you can manage your entire portfolio in one convenient place.

With Passiv, you can

- Set a target allocation for each asset in your portfolio

- Create asset classes and set a target allocation for each of them*

- Allocate cash and rebalance your portfolio in one-click*

- Exclude assets from your target portfolio

- Get notified whenever your portfolio drifts

*Available to Passiv Elite subscribers only.

As part of the integration, we’re giving you access to Passiv’s Elite tier for free for one year. Simply click here, sign up, and upgrade to Elite via the settings page.