If you are a true believer in bitcoin, don’t listen to Elon Musk. Bitcoin is bigger than Elon or Tesla.

On May 13th 2021, Elon Musk, the chief behind Tesla and SpaceX made a U-turn about bitcoin. He tweeted a post saying that Tesla has suspended the purchase of vehicle using Bitcoin, referring to the increasing use of fossil fuels for bitcoin mining. As a result, the price of BTC was down by 17% in less than three hours. A public figure like Elon Musk has a huge influence, considering

- the engineering challenges he has achieved so far in the making of Tesla and SpaceX

- he gives rise to memes and

3. he plays around with his nearly 55 million Twitter followers. We can also see how he is fiddling around with Dogecoin — a meme coin with no significant utility yet.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Nevertheless, if you are a true believer in bitcoin which is based on a decentralised and trustless network, you don’t have to care what influencers like Elon Musk are saying or twitting. Instead, focus on the core principle bitcoin has offered to us. Never in history has any technology given you so much power and freedom. People like Elon have nothing to do with altering the philosophy behind bitcoin. It is a decentralized virtual currency, which is not controlled by any government or corporation. At a time like this, you need to reflect on the core theory of bitcoin — being trustless, decentralized, scarce. Bitcoin’s blockchain technology is the best hedge against the corrupted monetary institution which has an infinite fiat money supply.

As we need to truly focus on the core value of bitcoin, let’s remind ourselves of the four fundamental economic problems bitcoin has solved.

- The economic value that is traded globally and freely

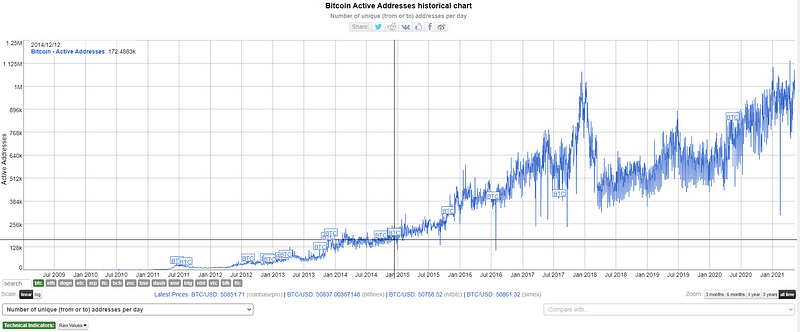

For the first time in human history, anybody can trade values globally and freely, without the interference of the government or regulatory agencies. When Satoshi Nakamoto created bitcoin, one of the core philosophies was to give freedom to anybody in the world to trade values peer-to-peer with anyone they wanted to do with. While in the traditional financial system, transferring values cost a huge sum of remittance in transaction fees and foreign exchange cost, with the bitcoin blockchain, every user has a digital wallet with public and private keys. Anyone can freely transact globally using the public keys. Today there are more than one million active bitcoin addresses. In a centralized finance institution like PayPal, every time a person sends money overseas, he/she exposes his/her identity, meaning, there is no censorship. This may not be a problem for everybody, but for people who don’t want their identity to be exposed every time they perform a transaction for whatsoever reason, it undermines their freedom and self-sovereign. With bitcoin, a person need not reveal his/her identity, or name or IP address. With the bitcoin public key, all this information will be censored. Anybody can send the values even being offline. This transfer of value can happen with anyone and anywhere. As of 2021, nearly 10 trillion values have been settled on the bitcoin blockchain.

Bitcoin is on the verge of settling a cumulative $10 TRILLION on-chain since inception.

Since 2018, Bitcoin has settled $7.5 trillion. Wild.

cc: @kenoshaking pic.twitter.com/SHduskM1Qw

— Yassine Elmandjra (@yassineARK) January 4, 2021

2. The economic value that is fully protected and owned wholly.

In traditional financial institutions, once a person deposits his/her money, the bank can use the money for whatever purpose they want, and technically, it is no longer to the person, though he/she has the legal right to withdraw his/her money anytime. The person’s money in the bank is just the number that the centralized institution can manipulate if they wish. The same thing applies to nonfungible assets like a house or land. If a person did anything against the government, the government can seize the property anytime they wish and the legal system including the local authority enforce and define the ownership status. Here is the thing, under all these systems, a person doesn’t wholly own what they legally own. Their ownership status is always defined and enforced by the authority and legal system. In the case of bitcoin, a person’s private key defines their ownership. Every user has a unique private key. This private key can be stored anywhere, be it cold storage or a piece of paper. This private key proves that a person has full protection and owns wholly over their economic value.

3. The economic value that is reliable and predictable

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.”

~Satoshi Nakamoto

It is no doubt that traditional financial institutions require trust to work, yet they misuse this trust. In August 1971, after the then-US President Nixon ended the convertibility of gold into dollars and vice versa, the central banks started printing unlimited fiat currency from the thin air. Amidst the COVID-19 pandemic, 35% of all US Dollars ever printed were printed in the last year. This made the traditional financial institution unreliable and unpredictable. In the case of bitcoin, the network itself is reliable because of its proof-of-work model. Every transaction is broadcasted across all nodes in the network. To make bitcoin predictable, by design, only 21 million bitcoin can ever be created, and anyone can know when and how all this bitcoin will be created.

4. The economic value that is verifiable

Banking is all about recording the transaction and maintaining those transactions in the form of a ledger. In a centralized financial institution, people don’t know whether these transactions are recorded as they ideally should be or are manipulated due to the lack of transparency. Thanks to blockchain technology, in the case of bitcoin, every transaction is recorded and verified in a distributed ledger that is available for anyone to see. You can download all the transactions that have ever happened since the first transaction in January 2009. A bitcoin user can validate and verify all the inbound transactions and also check whether bitcoin has been spent more than once. The network also allows users to verify the ownership of the economic value.

Conclusion

With the massive success of bitcoin over the last decade, it threatens traditional financial institutions. They will have to innovate and embrace bitcoin technology and make plans to co-exist with this impressive technology, otherwise, they will become irrelevant. Countries like Singapore and Japan are already making their way and attracting global investors to their pool. Bitcoin is here to stay. Though it may be hard to accept, it is changing the way we do banking. If governments and banks around the world make necessary friendly policies to welcome this technology, it will be a win-win for every human.

Note: This article is originally written and produce at Unocoin, India’s first and most secure Bitcoin and Crypto exchange.

Unocoin is India’s first and the most secure bitcoin trading app. This exchange app was founded in 2013. You can buy and sell bitcoin instantly using the Instant Buy and Sell feature. Not just this, you can also buy ETH and Sell ETH in no time. With more than eighty-seven coins listed on this best cryptocurrency exchange in India, you can also accept bitcoin from your friends from any location. You can also know which cryptocurrency works best for you with the price ticker and notifications. The most popular cryptocurrencies like Bitcoin (BTC), Ether (ETH), USDT (Tether), BNB, Ripple (XRP), Cardano (ADA), Solana (SOL), Binance USD (BUSD), Dogecoin (DOGE), Polkadot (DOT) and other popular altcoins can be traded on the go. The new Android and iOS applications make Unocoin the best cryptocurrency app. With the unique feature of the Systematic Buying Plan, you can buy and sell bitcoin and Ether periodically. What more? You can start your crypto journey using SBP for as little as INR 10. With another exciting feature called Crypto Basket, you can diversify your crypto portfolio based on market capitalisation (Market Cap) or Volume. These two excellent features make Unocoin the best cryptocurrency platform.

Love Crypto Coins. Love Unocoin.

Please find the list of authentic Unocoin accounts for all your queries below:

- YouTube Channel: https://www.youtube.com/c/Unocoin/videos

- Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Instagram: https://www.instagram.com/unocoin/

- Twitter: https://twitter.com/Unocoin

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- E-mail id: [email protected]

- Contact details: 7788978910 (09:30 AM IST — 06:30 PM, Mon — Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer:

Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).