Bitcoin has recently taken over the world and has created a space for a transparent, decentralized online payment system. It is basically virtual cash that you can use to buy or sell certain products and services on the internet. Each physical bitcoin has a private code printed in it. These codes help in converting bitcoins into computer files that you can carry on your phone like a digital wallet.

When talking about this cryptocurrency, halving, the importance of halving, and bitcoin halving price prediction are topics that cannot be avoided. This article will discuss bitcoin halving and related topics in detail.

What is a bitcoin halving event?

Ideally, 21 million bitcoins can ever be created. Bitcoin halving is an event that occurs after producing every 210,000 blocks or roughly four years until 21 million bitcoins have been produced by the miners; the bitcoin halving 2020 date was May 11th 2020. In this process, the new reward given to the miners in the form of bitcoins is cut in half. Bitcoin halving is aimed at decreasing the number of bitcoins generated in the network and limiting the supply of new coins.

Bitcoin halving is a process of manipulating the demand and supply forces to synthesize inflation. Such a change in the market forces results in an increase in the pricing of the cryptocurrency. Bitcoin is essentially known to be a deflationary asset, and bitcoin halving helps it to stay that way. Since this process is surrounded by hype and expectations, bitcoin halving price prediction is an unofficial event before the actual halving takes place.

About Unocoin

Unocoin is one of the leading crypto exchanges in India where you can buy or sell different types of cryptocurrencies. It is a platform designed for Indian users and has been in the cryptocurrency game since 2013. Additionally, Unocoin offers you SBP (Systematic Buying Plans) for bitcoins, which is the first-of-its-kind in the cryptocurrency industry.

Why is bitcoin halving important?

New bitcoins are generated through a ‘mining’ process that is very different from traditional mining. It is a process where individuals use specialized hardware for processing transactions and securing networks in exchange for newly generated bitcoins. There is a chance that the number of bitcoins generated in the market may increase due to an increase in competition within the miners.

This would lead to the supply and demand forces going up, which would cause the price to go down, ultimately leading to a bearish market. In order to control this situation, bitcoin halving takes place once every four years. The process regulates the supply and demand forces to control inflation and results in pushing the bitcoin prices higher. This process ensures that bitcoin is a long-term asset that is here to stay.

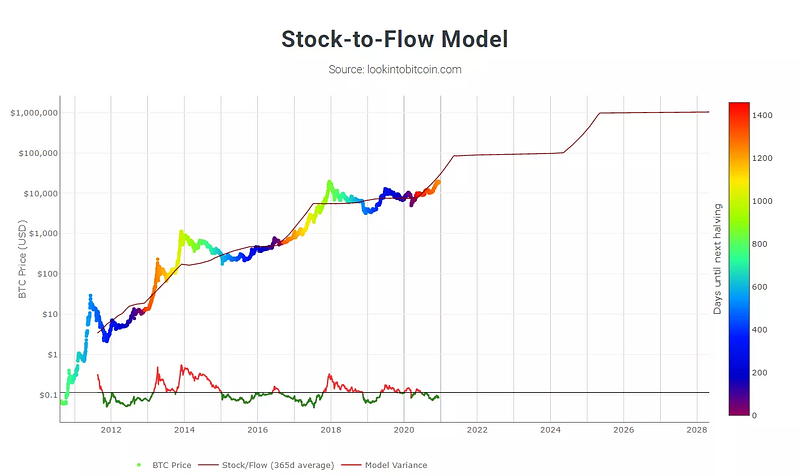

The previous bitcoin halving has resulted in a dramatic surge in price after an initial selloff. This has been a pattern for all the past halving events, as well. After each halving event, the price and demand for bitcoin experience a surge, essentially a bull market, that supersedes the previous one.

Past halving event dates

- The first halving was on November 28th, 2012.

- The second halving took place after the production of 420000 blocks in the network on July 9th, 2016.

- The third and most recent halving took place on May 11th, 2020.

- The next bitcoin halving date is expected to be in the year 2024.

The price-performance of bitcoins in past halving event dates

After the first bitcoin halving in November 2012, the price went from $ 12 to $ 1150 in a span of one year. The second halving event was on July 9th, 2016. On this day, there was a sudden drop in price, but it shot back to its original price in no time.

By December 2017, the price had gone from a mere $ 640 to $ 20 000. The event that’s fresh in our minds- the bitcoin halving 2020 date was May 11th, 2020, when the price was close to $ 8500, which did not change much in the first few months. Today, the price per bitcoin has surged up to $ 56,585.

Bitcoin has emerged as a safer and relatively more predictable investment which is why more and more people have gained interest in the same. In the past, despite a fall in the past, bitcoin has risen to new heights through the halving process. The next bitcoin halving date is predicted to be in 2024.

FAQs

1. Will bitcoin halving increase the price?

Judging from the past data, we can say that after an initial fall in price, bitcoin halving results in a drastic increase in price after a period of 3–8 months.

2. What date is the next bitcoin halving?

The next bitcoin halving date is predicted to be in 2024.

Unocoin is India’s first and the most secure bitcoin trading app. This exchange app was founded in 2013. You can buy and sell bitcoin instantly using the Instant Buy and Sell feature. Not just this, you can also buy ETH and Sell ETH in no time. With more than eighty-seven coins listed on this best cryptocurrency exchange in India, you can also accept bitcoin from your friends from any location. You can also know which cryptocurrency works best for you with the price ticker and notifications. The most popular cryptocurrencies like Bitcoin (BTC), Ether (ETH), USDT (Tether), BNB, Ripple (XRP), Cardano (ADA), Solana (SOL), Binance USD (BUSD), Dogecoin (DOGE), Polkadot (DOT) and other popular altcoins can be traded on the go. The new Android and iOS applications make Unocoin the best cryptocurrency app. With the unique feature of the Systematic Buying Plan, you can buy and sell bitcoin and Ether periodically. What more? You can start your crypto journey using SBP for as little as INR 10. With another exciting feature called Crypto Basket, you can diversify your crypto portfolio based on market capitalisation (Market Cap) or Volume. These two excellent features make Unocoin the best cryptocurrency platform.

Love Crypto Coins. Love Unocoin.

Please find the list of authentic Unocoin accounts for all your queries below:

- YouTube C

hannel: https://www.youtube.com/c/Unocoin/videos - Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Instagram: https://www.instagram.com/unocoin/

- Twitter: https://twitter.com/Unocoin

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- E-mail id: [email protected]

- Contact details: 7788978910 (09:30 AM IST — 06:30 PM, Mon — Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer:

Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).