The cryptoasset market has made its way up in the news due to phenomenal price increments in all the coins we keep seeing. While the market is volatile, cryptoassets like Bitcoin have shot their way up in the price graph within only the last few years.

What’s more interesting is that it does not seem to be slowing down anytime soon either! For instance, Bitcoin started off at $1000 per coin at the beginning of 2017 and rose up to $17,000 before the year ended. With such changes in its dollar value, most investors even claim that it can go up to a hundreds of thousands of dollars in the next 20 years.

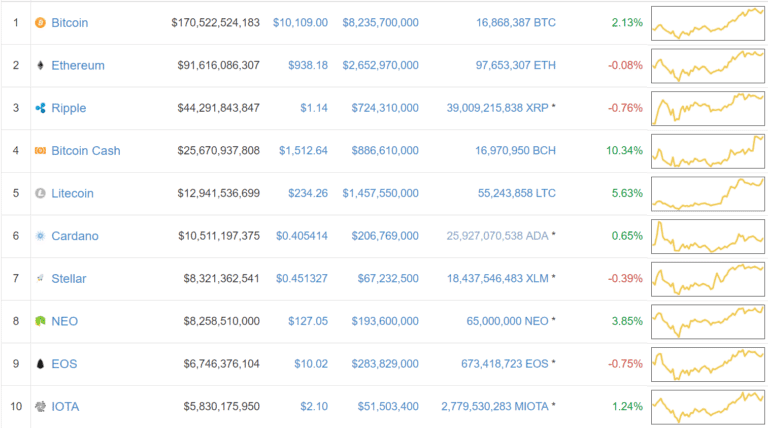

Cryptoassets made a huge leap from being just an academic concept to a reality with the creation of Bitcoin in 2009. Its soaring prices captured the imagination of many investors, opening the doors for more such assets to enter the marketplace. Riding on the back of Bitcoin’s success, cryptoassets like Ethereum, Ripple, Litecoin etc. have also been seeing some positive actions in their price graphs.

Many are understandably flocking to these other cryptoassets in the hope of catching on the next Bitcoin. Let’s give you a brief on them.

Popular alternative cryptoassets

- Litecoin — Litecoin has been designed for processing smaller transactions, faster. Litecoin was founded in October 2011 as “a coin that is silver to Bitcoin’s gold,” according to founder Charles Lee. As the name suggests, Litecoins can be easily mined by a normal desktop computer, unlike the heavy computer horsepower required for Bitcoin mining. Litecoin’s maximum limit is 84 million which is four times Bitcoin’s 21-million limit. Moreover, it has a transaction processing time of about 2.5 minutes which is one-fourth that of Bitcoin.

- Ripple — Ripple was launched by OpenCoin, which is a company founded by a technology entrepreneur, Chris Larsen in 2012. Just like Bitcoin, Ripple is both a asset and a payment system. The asset component is XRP, which has a mathematical foundation like Bitcoin. As opposed to Bitcoin transactions that take over 10 minutes, the payment mechanism of the Ripple enables the transfer of funds in any asset to another user within seconds.

- Ethereum– Ethereum is an open-source, public, blockchain-based digital asset that has a distributed computing platform. Its operating system features a smart scripting functionality. Introduced in 2015, Ethereum is considered to be one of the pioneer platforms in distributed ledger and blockchain technology. While the Bitcoin blockchain tracks the digital asset ownerships, the Ethereum blockchain focuses on running the programming code of any decentralized application.

However, having kept this in mind, many questions still arise; as to whether these assets will eventually become conventional assets and as ubiquitous as dollars. Or whether they are just a passing fad that will flame out before long?

So when should you invest in them?

Or should you not participate in this market at all?

Timing the cryptoasset market

Many wonder if they should take advantage of the market’s volatility, and buy on dips, or just buy and hold for the long term without having to deal with timing the market.

Cryptoassets face some limitations. For instance, your digital fortune can be erased completely by a computer crash, or a virtual vault can be ransacked by a hacker! However, when you think about it, which investment instrument is risk free? The risk associated with cryptoassets might be overcome with technological advancements in the near future.

There is no right time to enter or exit this changing market. While cryptoassets are volatile, picking the coins that offer some true fundamental value is likely to help you make gains over the long term. Coins such as Bitcoin Cash, Ethereum, Ripple and more — with a vibrant active community and real developmental work being done, can seem to be good bets in that regard.

The number of merchants who accept cryptoassets has steadily increased due to their rise in price. For cryptoassets to further become more widely used, they have to first gain widespread acceptance among more consumers.

The largest risk of entering or exiting the cryptoasset market with an unknown, random coin is that it is unpredictable and volatile. The value of can increase overnight or even decrease the same way.

While the idea of the merits and demerits of entering or exiting the cryptoasset market is highly debated upon, its supporters do point out its limited supply and its growing usage.

So if you think you can stomach the volatility of a cryptoasset market, investing in it is a definite thumbs up.