Billionaire entrepreneur and venture capitalist Peter Thiel — the man behind PayPal, and godfather of sorts at Facebook, is bullish on bitcoin, much like other Wall Street investors.

Speaking at the Future Investment Initiative in Riyadh, Saudi Arabia, Peter Thiel compared the cryptocurrency bitcoin to gold. ‘People are underestimating bitcoin and it has great potential left,’ he said.

He added, “I’m skeptical of most of them (cryptocurrencies), I do think people are a little bit underestimating bitcoin especially because it’s like a reserve form of money, it’s like gold, and it’s just a store of value.”

Even so, in Thiel’s opinion, like gold, it’s difficult to mine, making it more worthwhile. The PayPal founder and venture capitalist compared some of bitcoin’s features to gold. He went on to add that you don’t need to use it to make payments rather use it an asset.

There has been rising interest in bitcoin last year. The cryptocurrency recently hit a new record high above $20,000 and has rallied over 2000 percent last year.

Thiel said that bitcoin is based on the “security of the math”, which means it can’t be hacked and is highly secure. “Bitcoin is mineable like gold, it’s hard to mine, it’s actually harder to mine than gold. And so in that sense, it’s more constrained,” Thiel said.

JPMorgan CEO, Jamie Dimon is not the biggest fan of bitcoin and has called the cryptocurrency “a fraud that will eventually “blow up.” But he was exposed to his hypocrisy when JPMorgan itself was buying bitcoin in the millions after his comment.

The cryptocurrency has a limited supply and only 21 million bitcoin will be mined. Then there’s the camp occupying the middle ground, who don’t say it’s the best investment but also don’t say it’s the worst investment.

Other major figures involved in the business world have weighed in the debate over the sustainability of cryptocurrencies:

Khaldoon Al Mubarak, who heads Abu Dhabi’s Mubadala Investment Company, said he was “still on the fence” with regard to bitcoin and blockchain technology, but that people should look at both with an open mind. He also said that he doesn’t think it was a fraud. His biggest concern revolved around regulation.

Saudi billionaire investor Prince Alwaleed bin Talal said Monday that bitcoin will “implode” one day.

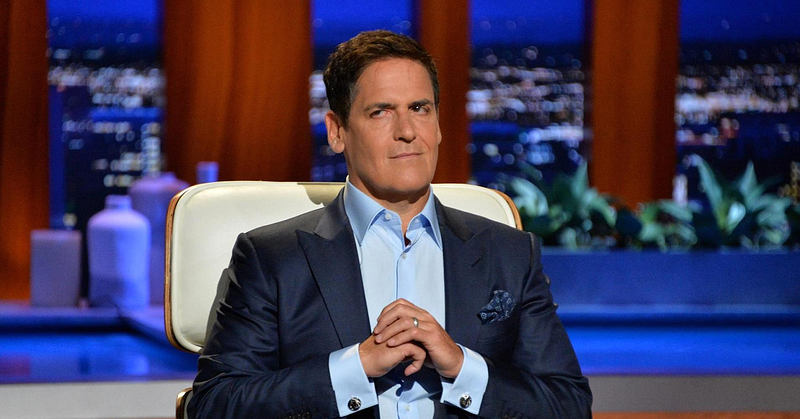

Billionaire tech mogul Mark Cuban seems to be among the skeptic group, as he told Vanity Fair that he would only recommend to invest up to 10 percent of your savings in high-risk investments, including bitcoin and ethereum. That shouldn’t sound discouraging at all — since 10% of your portfolio is like to rise to become 20–30% the way bitcoin has been rallying.

Some of the biggest names on Wall Street are also starting to embrace the digital currency, including Fundstrat’s Tom Lee and value investor Bill Miller, who is running a fund with nearly a third of its assets in bitcoin.

Billionaire venture capitalist Tim Draper, who grew big as an early backer of Baidu and Skype, became the first prominent venture capitalist to openly embrace initial coin offerings.

Draper soon plans to take a step further into the world of cryptocurrency by buying a new digital currency offered by a technology start-up Tezos. Tezos is a new blockchain platform launched by a husband-and-wife team with extensive Wall Street and hedge fund backgrounds.

Some of these billionaires have accepted the digital currency with an open mind, while others are skeptical about the regulation policy. Some of them have also invested in blockchain technology and showed a keen interest in the currency. Irrespective, the currency is booming, with its value trading over $14,000 at the time of writing.

Also Read:

https://blog.unocoin.com/how-much-electrical-power-does-the-bitcoin-network-use-e43ff150d6b7