Forking is an event that increases the notional value of the cryptocurrency while keeping its blockchain network secured and improved but it is by default secured and improved, as it is immutable. The overall notional value increases as the fork generally bring something new to the table. In this article, you will learn about what cryptocurrency forking is, what are the different types of forks available in this industry, what is a hard fork and what are the effects of a hard fork on cryptocurrency.

Most of the countries in the world have legalized the use of cryptocurrencies in the last few years, and due to this reason, a large number of people have started investing in these cryptocurrencies. If you hold some knowledge of cryptocurrency or if you are completely aware of the digital currency market, then you might also have heard the new buzzword, which is termed as ‘forking’.

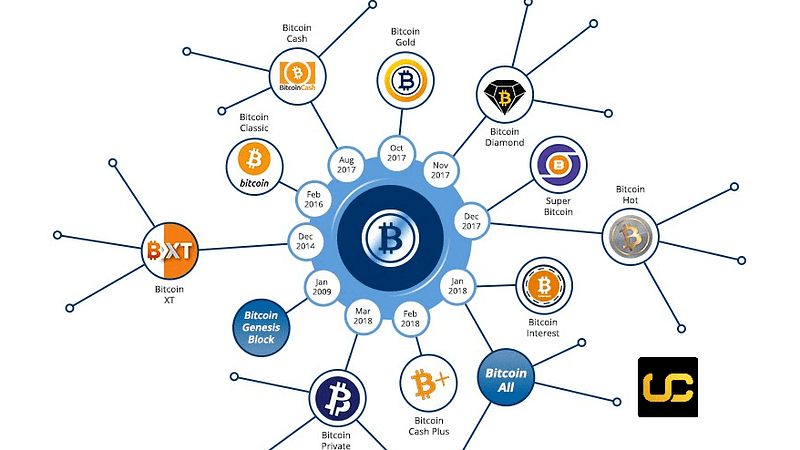

Forking is nothing but the splitting of the interface on which the bitcoin operates and making that new thread of the split move in another different direction. This usually happens when the bitcoin miners perceive that they can mine out better alternatives than existing bitcoin. Apart from this, forking also holds a lot of other added advantages when it comes to investing in cryptocurrencies.

About Unocoin

Unocoin is a leading Bitcoin and Ethereum trading platform that holds the most comprehensive ecosystem of cryptocurrency traders in India. Founded in 2013, the platform was the first in India to enter the bitcoin market. Unocoin’s unique platform allows bulk trading through over-the-counter (OTC) trade features.

What is a cryptocurrency fork?

A cryptocurrency fork can be defined as a series of events in a blockchain where the principal string is replicated with a variation in it. It can also be understood as a variation in the protocol of the blockchain interface as a blockchain is disseminated over two paths. Cryptocurrency forks are getting popular these days due to a new rule that is formed for the transaction of cryptocurrency trading. A fork is usually placed to prevent the collision of both the paths of a blockchain so that they can operate without any hindrances and also for a longer duration.

A person can easily use both the paths of a blockchain; however, they cannot transfer the crypto data from one path to another path. An instance of this can be the shift of more people away from one path as it tended towards losing its popularity day by day among its users. Those participating in the network need to follow certain guidelines to continue participating in a blockchain. These guidelines are known as a “protocol.” Forking in cryptocurrencies is differentiated into two based on the change in this protocol.

What are the different types of forks?

In the field of cryptocurrency, there are simply two kinds of forks available based on their functionality. These are — a soft fork and a hard fork. Both these forks have a very minute difference between them. Explained below are the two kinds of a bitcoin fork.

Bitcoin Soft Fork

A soft fork in cryptocurrency is a change in the protocol that makes the previous version of block data to be valid for future blocks after the fork but the newer version of block can also contain something new that got introduced due to the fork. The new nodes are recognized as valid by the old ones, making this forking type backwards-compatible. An instance of a soft fork can be the precise tuning of aspects related to the dimension of the blocks (only increase but not decrease) in a blockchain or a slight variation in the features of the bitcoin soft fork trade.

However, it must be kept in mind that only a majority of the participating interfaces should be in favor of the new changes that will result in a bitcoin soft fork. It is not at all compulsory for all the network participants to update to the newer version as it is equally compatible with the former versions as well.

That said, the more miners who work on the newly updated network, the more secure the network is. For instance, if you have ¾ of miners agreeing with the new and ¼ of miners not, then you have ¼ of blocks that are compatible only to the old node; this means the new nodes ignore this ¼ of blocks.

Bitcoin Hard Fork

A hard fork in a cryptocurrency can be defined as the generation of a new string in the system interface that shares a similar past with the primary string in the interface but with a certain number of changes in the protocol. These changes need to be accepted by all the miners in a network. A hard fork usually takes place when the connections of a more recent redaction of blockchain do not agree to receive the former protocol of the interface and when a new rule is added to the network, a hard fork in a cryptocurrency is created.

In other words, a hard bitcoin fork can be defined as a software update that is not congruent with the former versions of the interface that splits up one cryptocurrency into two different parts. There are a lot of reasons why the developers implement a hard fork in the systems, like rectifying significant protection threats that were detected in the previous versions, adding some new functions, or reversing any points that are previously present in the older versions (reversal of a soft fork).

What are the reasons for introducing forks?

There is a multitude of reasons why a system developer in the blockchain or crypto industry introduces a fork in a network. The primary reason for introducing a fork is to resolve all the bugs spotted in the previous networks and further provide them with enhanced protection, which the older software was not able to provide.

There is very little difference between the two forks (soft and hard). Both are implemented to improve the network in one way or another and make it easier for miners to do their job. They only differ in terms of the consequences of the forking; as in, after a bitcoin soft fork, the network remains the same, while with hard forks, there will be two networks: the old one and the copy of the old one with the changes!

How to recognize the hard fork?

A hard fork can easily be recognized when there is a variation in the interface that cuts down on the backward compatibility. Also, a hard fork in the interface usually creates a division in the blockchain that may become a cryptocurrency on its own. In this situation, both the old and the new versions move hand in hand in their functionality and remain separated at the same time.

What are the effects of a hard fork?

A digital currency can undergo a hard fork for several reasons. A hard fork in a cryptocurrency can hold numerous effects on the cryptocurrency. Some of the effects of a hard fork are mentioned below:

More Speedy Network

Employing a hard fork in the interface can result in a more speedy network by splitting one digital currency into two parts. In the present era, more organizations are utilizing hard forks for taking added advantages and a more secured network.

It enhances the value of a cryptocurrency

Another critical and important effect of employing a hard fork is the significant increase in the price or value of a cryptocurrency as something new and improved is now available. Hence, it can be easily asserted that forking does play a major role in adding value to a cryptocurrency. As investors, a hard fork is something to keep an eye on.

Forking is an event where a blockchain is duplicated with a change. Soft and hard forks are two types that deve

lopers use to implement changes to the blockchain network. The primary reason for creating a fork in the blockchain is to add a new feature to the network, something the older version failed to have. As such, it is a great way to secure the network and increase the value of cryptocurrencies.

FAQs

1. Is TRON a fork of Ethereum?

The Real-time Operating System (TRON) is a decentralized operating system that is based on a cryptocurrency known as a Tronix (TRX). It duplicates an industry model on a common blockchain interface and serves as a dispersed, decentralized storehouse, and is more effective and cost-efficient. TRON was created on an Ethereum token (ERC-20) before it moved to an independent network in 2018. Since then, TRON has been marketed as a competitor to Ethereum.

2. What happens when Ethereum forks?

When an Ethereum forks, depending on the fork, it may become more secure and scalable. Enough research has to be performed by the buyers to understand that whenever a person buys an Ethereum, numerous alternative chains of Ethereum forking may take place in a digital currency as and when required for its security some of which may result as a hard-fork.

Unocoin is India’s first and the most secure bitcoin trading app. This exchange app was founded in 2013. You can buy and sell bitcoin instantly using the Instant Buy and Sell feature. Not just this, you can also buy ETH and Sell ETH in no time. With more than eighty-seven coins listed on this best cryptocurrency exchange in India, you can also accept bitcoin from your friends from any location. You can also know which cryptocurrency works best for you with the price ticker and notifications. The most popular cryptocurrencies like Bitcoin (BTC), Ether (ETH), USDT (Tether), BNB, Ripple (XRP), Cardano (ADA), Solana (SOL), Binance USD (BUSD), Dogecoin (DOGE), Polkadot (DOT) and other popular altcoins can be traded on the go. The new Android and iOS applications make Unocoin the best cryptocurrency app. With the unique feature of the Systematic Buying Plan, you can buy and sell bitcoin and Ether periodically. What more? You can start your crypto journey using SBP for as little as INR 10. With another exciting feature called Crypto Basket, you can diversify your crypto portfolio based on market capitalisation (Market Cap) or Volume. These two excellent features make Unocoin the best cryptocurrency platform.

Love Crypto Coins. Love Unocoin.

Please find the list of authentic Unocoin accounts for all your queries below:

- YouTube Channel: https://www.youtube.com/c/Unocoin/videos

- Newsletter: https://medium.com/subscribe/@Unocoin_growth

- Blogs: https://blog.unocoin.com

- Instagram: https://www.instagram.com/unocoin/

- Twitter: https://twitter.com/Unocoin

- Facebook: https://www.facebook.com/unocoin/

- LinkedIn: https://in.linkedin.com/company/unocoin

- Telegram Group: https://t.me/Unocoin_Group

- Telegram Channel: https://t.me/+fasQhTKBsfA5N2Zl

- Telegram: https://t.me/UnocoinSupport_Bot

- E-mail id: [email protected]

- Contact details: 7788978910 (09:30 AM IST — 06:30 PM, Mon — Sat)

- App store link: https://apps.apple.com/us/app/unocoin/id1030422972?ls=1

- Playstore link: https://play.google.com/store/apps/details?id=com.unocoin.unocoinwallet

Disclaimer:

Crypto products are unregulated as of this date in India. They could be highly volatile. At Unocoin, we understand that there is a need to protect consumer interests as this form of trading and investment has risks that consumers may not be aware of. To ensure that consumers who deal in crypto products are not misled, they are advised to DYOR (Do Your Own Research).