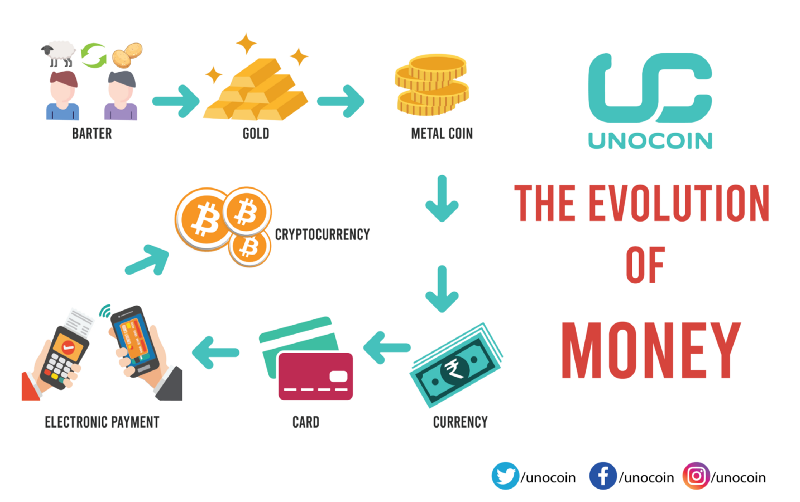

Money is arguably the greatest driver of things in the world today, but it isn’t real and hence based on trust. Learn more about the evolution of money from the primordial barter system to its latest avatar— cryptocurrency.

It is no exaggeration to say that money makes the world go round. Nations and religions can be bitterly divided over territory and oil reserves but we all seem to believe in a rectangular piece of paper. Ironically, money has proved to be an efficient unifier and a universal motivator of human beings. It is inextricably linked to power and status across societies which may not even speak the same language. This probably explains why in the time we’re living in, the economic consequences of the pandemic are stressed far more than the loss of human lives.

But if you think about it, money in itself has no value- it is merely a piece of paper, a disk of dull metal or a number on a screen. It is people who assign value to money and it retains it by being a medium of exchange, a unit of measurement and a trusted storehouse of wealth. And money buys us the most vital of all resources- time.

Let’s chart the evolution of money.

Bartering:

Since human beings first started collaborating with each other, they have exchanged goods. A man could exchange a cow for a fish, as long as he found another man who needed his cow and was willing to trade it for his fish. But trade and bartering depended on a coincidence of wants. If the first man wanted a fish that day but the second wanted a full-grown cow and not a calf, the fish would have to wait for a few months, by when it would become inedible. The deal would thus only be struck if all these factors aligned for both parties.

Gold and other precious materials:

This gave rise to the need for a third good with universal value so we didn’t have to go through a long chain of bartering. Apart from being durable and portable, this third good would have to be scarcely available or acquired with great difficulty for it to be valuable. In the past, we came up with various ideas for it- salt, gold, silk, seashells or even limestone doughnuts.

But as we grew in numbers, settled, built cities and started farming, it became difficult to depend on a precious object as currency which could not accommodate the needs of a swelling society. This paved the way for token currency.

Token Currency:

Ancient Indians were one of the earliest issuers of coins in the world, along with the Chinese and the Lydians. It is around the 6th century BC that punch-marked coins came into existence in their societies. They were usually minted by the authority which governed these republics, in most cases the monarch. This was by far the most reliable and enduring money and continued well into 17th century Europe. But with this format, there came a risk.

We have all heard about Sultan Mohammed Bin Tughluq of Delhi whose token currency met a disastrous end. As the Sultan found it difficult to maintain a supply of gold and silver coins in huge amounts, the administration resorted to minting vast quantities of new copper and brass coins that could be exchanged for fixed amounts of gold and silver. But because of an overly simplistic design and the absence of cryptic seals, this decision proved to be a boon for forgers, who started minting a large number of fake coins. With the rapid increase in the numbers, these tokens became valueless, leading to hyperinflation and economic chaos.

Paper Currency:

Based on our learning from the previous failures in circulating money, the idea of paper currency was born. It received an impetus from the colonial governments around the world who joined several economies and brought them under the same crown. Paper money was a continuation of representative money, which eventually came to be replaced by fiat money. Fiat is the Latin word for ‘let it be done’. Money is thus given a value by a government decree or a promise, admitting an enforceable legal tender, which means that by law, the refusal of ‘legal tender’ money in favour of some other form of payment is illegal.

Electronic payments:

The digital age ushered in two disruptive forms of currency: Mobile payments and virtual currency. Removing the need for cash, electronic payments necessitated the use of credit and debit cards and payment gateways for fund transfers.

Cryptocurrency:

Human progress is built on identifying problems within a system and seeking out solutions to resolve them. Fiat money involved a third party, usually a federal or central bank, which is not free from human errors or ethical compromise. Following the 2008 financial crisis, people were disenchanted with the ‘too big to fail’ idea behind banks. This disillusionment precipitated the birth of Bitcoin in 2009 with the release of the white paper on cryptocurrency by the pseudonymous Satoshi Nakamoto.

Bitcoin’s entry in the market took virtual currencies to the next level with the use of state of the art technology called cryptography. The appeal of cryptocurrencies is that all transactions are stored in a universal ledger online called the blockchain, which can be accessed by any user on the system. Operated by a decentralised authority, it also holds out the promise of lower transaction fees than usual online payment formats. Today, there are over 3000 cryptocurrencies in circulation around the world and to remain ahead of the game in money, knowledge of cryptocurrency is mandatory. To up your game, sign up for one of our many engaging courses by experts on Unoversity today.