(Re-introducing Crypto Basket from June 2018)

Although many cryptoassets failed to succeed yet, it is always nice to have a wide range of choice around you when you look to make a decision. Now with Unodax providing user the freedom to pick and choose their investments through a multi-crypto exchange — there’s plenty to choose from — Bitcoin, Bitcoin Cash, Bitcoin Gold, Ripple, Litecoin, and Ethereum. Buy them, sell them or transfer them into and out of your wallet, all through the app or web platform in a matter of seconds.

This is an open order book exchange — which means the buy and sell prices are set by the users themselves. Users set the prices as well as can to see all the orders in the book.

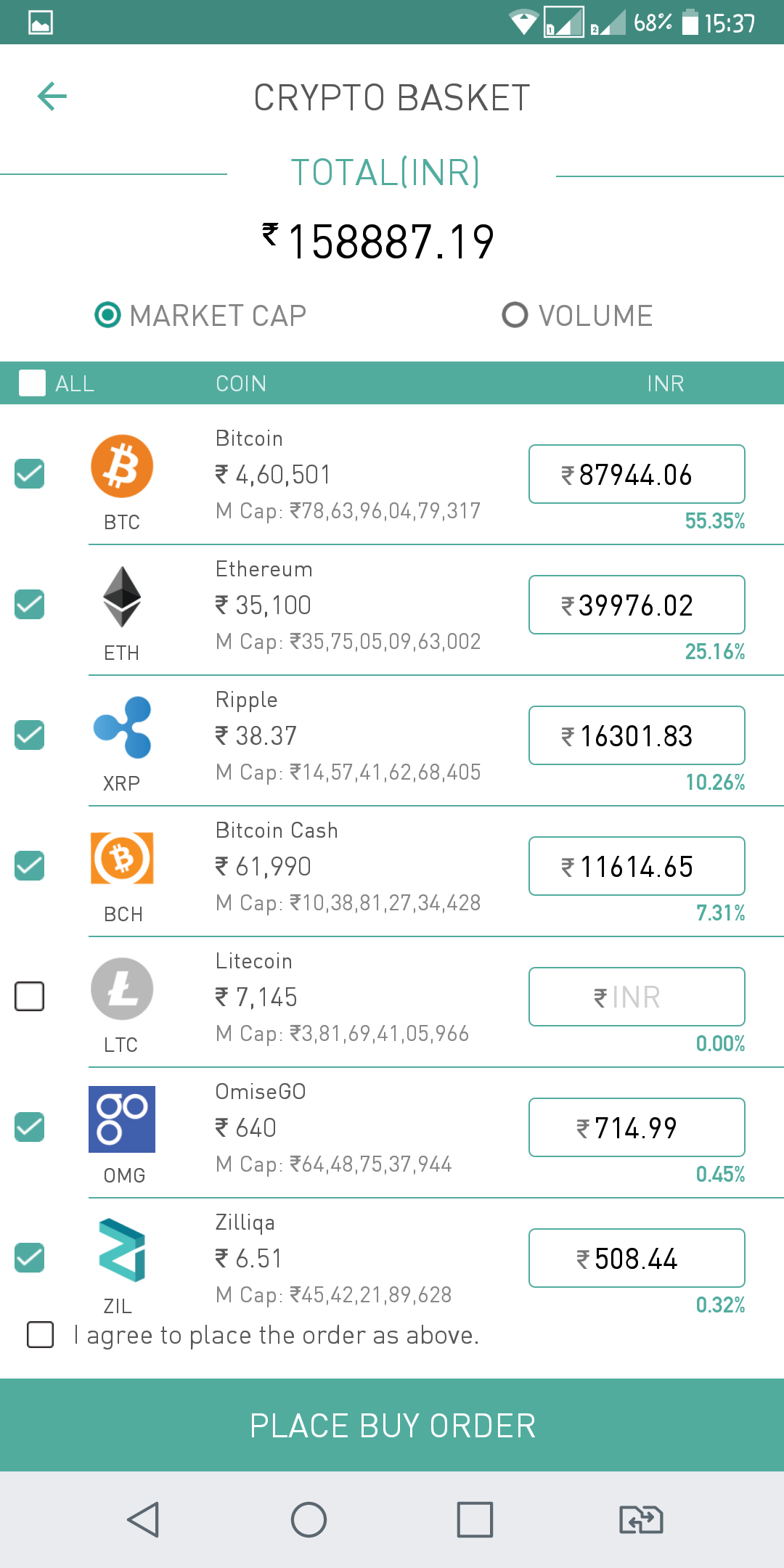

Now, Unodax is going a step further on customer delight, introducing weighted basket orders. Presenting ‘Crypto Basket’. Unodax is trying to save you the trouble of having to do large amounts of research before you pick your coin. Based upon the ratio of the market cap of the asset and the volume traded on the platform, Unodax let’s you invest in all of them with a simple click! No more FOMO (Fear of Missing Out) on the next crypto to boom!

In simple words, the basket order helps you to place orders for multiple cryptoassets with a fund distribution model of your choice. You can let Unodax set the distribution for you, or choose your custom distribution model as well!

How Can You Get Started?

The first step is setting a fixed amount of investment that you want to make.

- For example, let’s say you decide to make an investment of ₹6,00,000. Now this whole sum would be divided among multiple cryptoassets. If you wish to put your money in Bitcoin, Ripple and Ethereum, it could be distributed in a ratio of 50% in Bitcoin, 25% in Ripple and 25% in Ethereum. Hence, you now hold ₹3,00,000 in Bitcoin ₹1,50,000 in both Ripple and Ethereum.

Now, there can be two ways of trading these cryptoassets:

- You either wait and hold for the prices of these cryptos to increase so that you may sell your holdings at the market price. However this process reduces the liquidity of the system, as there is no extra money input into the system. It is therefore a ‘taker’ transaction.

- Or, you put up a negotiable order on the order book where you specify your price to execute the trade at. Interested buyers may then place their orders, and the transaction goes through. This is the ‘maker’ model, where there is an inflow of money. This increases the liquidity of the system.

When placing orders via the Crypto Basket, these orders would be placed on the order book as a limit order for Latest Trade Price (LTP) of the cryptoasset.

The launch of Crypto Basket and its newer updates, with Unodax’s existing trading services, further strengthens the crypto-market in India. Download the Unodax app, and fire up the experience of cryptoasset trading the way it is meant to be done.