There is no doubt that Bitcoin is one of the most welcomed crypto assets by enthusiasts and new users alike. The value of Bitcoin too has risen exponentially pleasing the likes of all investors. However, there are a few challenges that affect its current users and those that Bitcoin is yet to overcome:

1. Slow transactions

Bitcoin is facing a major challenge as the time taken to process transactions has increased dramatically. This has caused businesses to stop accepting the crypto asset. The problem of slow transactions has been looming around for quite some time. The challenge lies in how transactions are processed on the blockchain — the decentralized, distributed ledger technology that underpins bitcoin. The average time taken for a bitcoin transaction to be verified is about 43 minutes, while some transactions could also remain unverified forever.

The reason behind this issue is that a bitcoin transaction costs fees, which means those offering a higher fee get verified first. This creates a queue in the list of transactions, and those who don’t pay a fee or didn’t pay a sufficiently big fee are often kept waiting for hours and sometimes even days for a transaction to complete.

When someone uses bitcoins to pay for an item in a shop, that transaction needs to be verified on the blockchain. This is done by what are known as miners — individuals or groups who use massive computing power to solve increasingly complex mathematical equations to mine new bitcoins. Bitcoins come in “blocks” and are mined about every 10 minutes. The result of the slowdown in transaction clearance rates has led some businesses to give up on bitcoin completely while others are recommending users to switch from Bitcoin to alternative crypto assets like Litecoin.

2. Expensive transactions

The transactions are subject to a transaction fee which also creates a queue of pending transactions. The order of implementation depends on the highest amount that is paid as transaction fee. Therefore, for a person who wants to send money across immediately will have to pay an exorbitant transaction fee which will in turn make his transaction unnecessarily expensive.

Due to this problem, people are seeking fast and cheap alternatives to Bitcoin to free themselves of slow and expensive transactions.

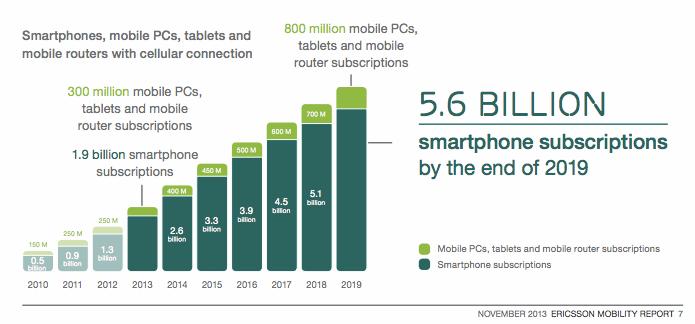

3. Poor mobile platform support

Despite having a huge market presence, it is shocking to see tech-giants like Apple and Google still do not support Bitcoin on their mobile platforms. Recently, Apple had decided to ban bitcoin wallets on the App Store. Furthermore, Google too does not allow in-app payments with bitcoin. Although this has not deterred some developers from creating mobile applications for Bitcoin, it sure is harming the ecosystem. These larger technology companies do not want to have any dealings with Bitcoin. So they emulate what restrictive governments do and use their power as leaders in the tech-space to regulate the use of Bitcoin at least within their platform.

Bitcoin is an excellent as a method of remote payment. It is also a competitive credit card alternative — especially in remote transactions with mobile or wearable devices. And this is a much better way to receive and send payments instead of using of QR codes.

Bluetooth Low Energy, Near Field Communication (NFC) or some other wireless technology has changed the way people make payments.

However, with billions of dollars relying on the outcome, the major players in the technology industry will do their best to restrict innovations that they have no control over.

For better growth, it is very important that Bitcoin is able to overcome this challenge to become a mainstream method of payment.

4. Privacy

Lack of privacy on public blockchain is a major challenge faced by Bitcoin which could make people want to switch to other crypto assets. An issue is the common myth that Bitcoin is a private system, which is not the case in reality. Bitcoin is more anonymous than private.

A Bitcoin transaction is not encrypted. It’s hashed. Every transaction that takes place is available for public scrutiny and analysis. Instead of being an advantage, this point has been used against the asset. It is being considered as a major privacy concern associated with conducting transactions using Bitcoin.

Projects like DarkWallet (now, renamed as Dash wallet) have recognized this issue with Bitcoin and are addressing it to their advantage.

5. Scalability

Scalability is another challenge for Bitcoin. It is potentially keeping this crypto asset out of the hands of potentially a larger user base. The problem of scalability arises due to Bitcoin’s nature of essentially having a limit on the number of transactions that can occur within a certain time frame. This limit is placed in order to prevent the blockchain size from spiralling out of control. As of now, the network has never hit this limit, but it will happen eventually if Bitcoin becomes a mainstream form of payment.

Mike Hearn, a former Google engineer who now works on a variety of Bitcoin-related projects thinks it could take more than ten years to fix Bitcoin’s scalability problem.

With due research and development, Bitcoin could surely overcome these challenges to retain and thrive in its position as one of the best crypto assets in the market. Despite all of these challenges, it continues to rally and see global adoption.

Also Read:

https://blog.unocoin.com/how-cryptocurrencies-are-the-true-enablers-of-globalisation-cc5b533c126e