There are many, many questions that surround Bitcoins. Ranging from how they have become so valuable, to their future viability. The most common one is perhaps — “Who created Bitcoins?”

Quick History

There is no straightforward answer to this question. The identification of bitcoins’ inventor remains a mystery. All that we have is a pseudonym — Satoshi Nakamoto — and we’ve covered Satoshi Nakamoto extensively in a previous post. Nakamoto’s accounts are no longer active and the coins in his wallet too have never been spent. Satoshi Nakamoto has disappeared from the world, or so it seems like it.

However, we do have some interesting facts about the rise of these currencies:

- Firstly, on October 31st, 2008, “Bitcoin: A Peer-to-Peer Electronic Cash System” was posted to a cryptography mailing list which was published under the name “Satoshi Nakamoto”. This whitepaper had outlined the foundation of how the Bitcoin would operate.

- Secondly, on August 18, 2008, an unknown entity registered the Bitcoin.org domain.

- And finally, on January 8th, 2009, the first version of Bitcoin was announced, and shortly after, Bitcoin mining began.

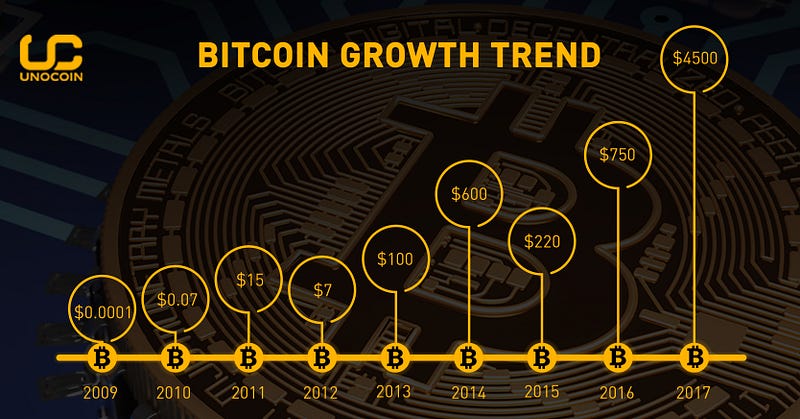

The Growth and Value History Of Bitcoins

Until 2013, almost all markets that consisted of bitcoins were in US dollars. In the beginning of April in 2013, the price per bitcoin dropped from $266 to around $50 and then rose to around $100. Again in late June 2013, the price dropped steadily to $70. However, the price began to recover steadily, peaking once again on October 1st that year, at $140.

On October 2nd, The Silk Road was seized by the FBI causing a flash crash to $110. Yet, the price rapidly rebounded, returning to $200 several weeks later.

In April 2014, the prices fell to around $400, before rallying in the middle of the year. It then declined to around $200 in early months of 2015.

During May-June 2016, there was a large spike in the value of Bitcoins which reached up to $750. By the end of September 2016, this value was stabilized.

However, Bitcoins took a large growth pill in the second quarter of 2017, where prices have now doubled from $1200 to over $2500.

As of early August 2017, the value of a Bitcoin is equivalent to $3900.

Clearly, there’s no stopping bitcoins. Minor setbacks aside, the price will clearly only increase. Why though? This brings us to its next aspect — acceptability.

Acceptability of Bitcoins

Bitcoins are still more perceived as investments than payments as of now. As their mainstream acceptability continues to grow, proper regulation will follow.

Digital currencies became very popular among tech businesses as they needed transferring of large amounts of funds overseas. Bitcoins also became famous amongst the criminal class for drug dealing and money laundering online.

While some countries have explicitly allowed use and trade of Bitcoins, certain others have banned or have restricted it.

As of now, the general acceptability of Bitcoins is lower than other payment methods and currencies. This is especially due to the fact that the concept of crypto-currencies is still new to the mass.

An interesting turn of events is the acceptance of Bitcoins in the educational industry. Several colleges around the world have begun to accept Bitcoins as a means of payment. This is a move which will easily help bring cryptocurrency right into the mainstream.

Finally, the acceptance of Bitcoins, in general, has already made many companies consider genuine investment opportunities in the currency, further fueling its journey into the mainstream world. Hence, it is not extremely unusual to find savvy businesses accepting Bitcoins as a payment method for most goods and services.

Market Capitalization

Market capitalization is the total dollar market value of a commodity. The investment community uses this figure in order to determine its economic size, as opposed to using sales or total transaction figures.

Bitcoin’s market capitalization now (at the time of writing this article) stands at $31.89 billion. The currency is now seeing over $129 million in 24-hour trades making it the fourth highest trading volume across global cryptocurrency markets. A large number of factors are responsible for the rise of Bitcoins all the way from an increased trading in Japan to debates over the future of Bitcoin’s underlying technology.

A Bitcoin Future

It’s necessary to understand that, much like the early days of 1992, Bitcoin is a new technology — and new technologies take decades to reach critical masses. But, just like the Internet, no one wants to miss out on the ‘next big thing’ — and bitcoin has more or less established itself as one of those.

Also read:

https://blog.unocoin.com/how-can-you-get-bitcoins-in-india-7f1875fcd847